Introduction

Alaska and Hawaiian may merge. If that happens, Hawaiian miles will transform into Alaska MileagePlan miles in a way that “preserve[s] the value of HawaiianMiles at a one-to-one ratio“. This has a bunch of people excited because:

- Alaska MileagePlan miles are hard to earn

- HawaiianMiles are easy to earn via American Express Membership Rewards

Alaska MileagePlan miles are valuable partially because Alaska is smaller than the big four major US airlines, and partially because again, they’re hard to earn. HawaiianMiles aren’t worth much relative to most major airline currencies, but if the merger completes then HawaiianMiles will balloon in value overnight.

The Play

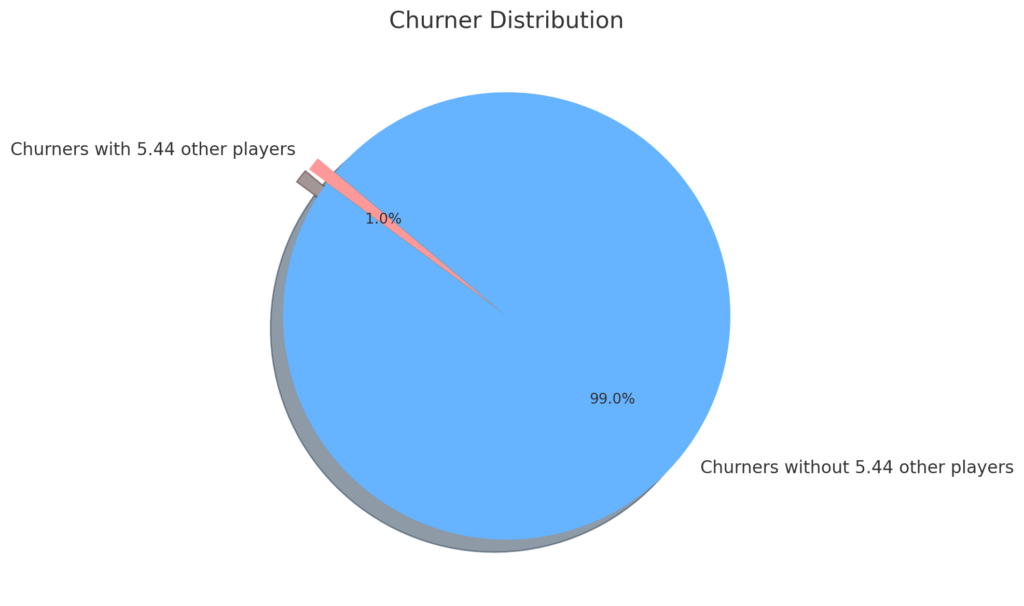

Of course, gamers gonna game, and the opportunity to turn low value, easy to earn miles into more valuable miles is an obvious and attractive play. In fact, I’ll be running this play; I too like turning low value things into high value things just as much as the next churner.

The Scale

How big should you go? There are risks to going too big, namely:

- Alaska MileagePlan will devalue its currency in the future

- The value of an unredeemed point is zero

- Lots of people have a hard time actually using Alaska miles

On the first point, what’s the expectation value for a time to devaluation? I’d guess it falls between 18 months and 24 months based on past history. How bad is a devaluation? Usually, an average 30% increase in redemption cost is a reasonable upper limit.

The Answer

That brings a simple math formula to calculate how many miles to transfer: the number of miles I expect to redeem in the next 18 months, plus the number of miles to redeem in the following 18 months devalued by 30%, minus the number of miles I expect to earn in other ways.

The numbers for me, which are based completely on how many MileagePlan miles I earned and burned used over the last 18 months:

- 0-18 month range:

- 900,000 miles to burn

- 800,000 miles to earn

- 19-36 month range:

- 900,000 miles to burn * 130% for a devaluation

- 800,000 miles to earn

Running the math:

miles = (900,000 – 800,000 + 900,000 * 130% – 800,000 = 470,000 miles

And if I do it before the 20% Membership Rewards transfer bonus to Hawaiian ends on Sunday night:

miles = 470,000 / 1.20 = ~392,000 miles

So, 392,000 Membership Rewards transferred will cover me (probably) for the next 36 months. Very mindful, very demure, very cutesy. But, what about travel past 36 months from now, you ask? I guarantee my situation, the US airline situation, airline transfer partners, airline alliances, and my travel needs will be different in 36 months, and speculation beyond that timeframe is at best a guessing game, especially since an unredeemed point is worth zero.

Happy transfers friends!

Alaska’s new 2026 alliance announcement.