- PayPal has a 4% cashback deal for six more days at Safeway with apparently no transaction size limit. Even better, according to brykupono at reddit, you can cycle the deal repeatedly for up to an hour by re-adding the offer to your account after each transaction.

To trigger the deal you’ll have to checkout with a PayPal QR code from your mobile app which is interesting for other reasons too, like for hitting Chase Freedom Q4 bonus categories or for other less obvious games.

- Vanillagift.com has fee free physical and virtual gift cards with promo code cyberdeals22. These cards are usually easy to liquidate, but watch out when purchasing because lately they’ve been charging as a cash advance on American Express cards.

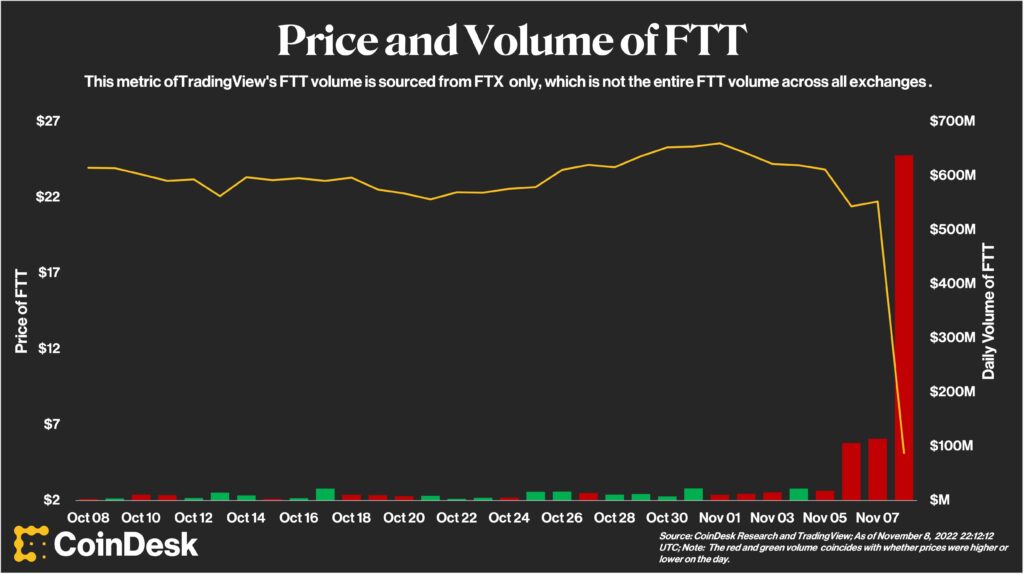

- Nearside, the King George III of banks, accidentally announced on Monday via email that part of their business operations were shutting down in the near future. They quickly followed up with an “oops, sorry, ignore that message”, then yesterday sent a message saying essentially “actually guys, sorry, lol, mah bad, we’re dying on December 23 for Christmas, lmfao”. I guess unlimited 2.2% cashback on debit transactions may not be a sound business decision, but what do I know anyway?

If you have money at Nearside, I’d transfer it out sooner rather than later (I did the moment the first message came in, I didn’t need to wait for the rest of the drama to play out).

- Dell is 15x and Saks Fifth Avenue is 10x at Rakuten’s shopping portal for the holiday, so it’s a good time to liquidate American Express Platinum and Business Platinum credits. Even better, SideShowBob233 notes that Drop has 100 points per dollar or 10% back at Dell, and it stacks with portals too. If my math is correct that brings Dell prices down to about par with other retailers, except you still get the frustration of Dell’s order system for no extra charge.

Nearside wishes you a Happy Thanksgiving. No, wait, go away! Just kidding, Happy Thanksgiving.