- Kroger has a 4x fuel points sale on third party gift cards other than Amazon starting tomorrow and running through Monday evening.

And with Target resale rates recently returning to 91%+, I think it’s safe to say the major brand bulk gift card reselling market has healed from its Pepper burns. - Blit Rewards* cut earnings on rent payments made with a credit card to 0.5x.

- Bluebird and Serve will be shutting down in June 2026, which gives you *checks notes* a full year to finish abusing them, ideally with five per social security number.

- Citi ThankYou’s reduced value cash-out for Strata Premier cardholders won’t affect those with linked Rewards+ or Double Cash cards in their ThankYou Points accounts. To link your Premier and another card to the same ThankYou Point pool, call 800-842-6596.

Note that linked cards can be unlinked in the future, but it does weird things to points held in your account and may inadvertently cause points expiration depending on your card portfolio. To be safe if you ever unlink, make sure every card has earned at least one point in the last 18 months.

*The company gets too much undeserved press, so (1) I’m not linking them, and (2) quoting reader Jim’s sage advice “I don’t care what the media says about me as long as they spell my name right.”

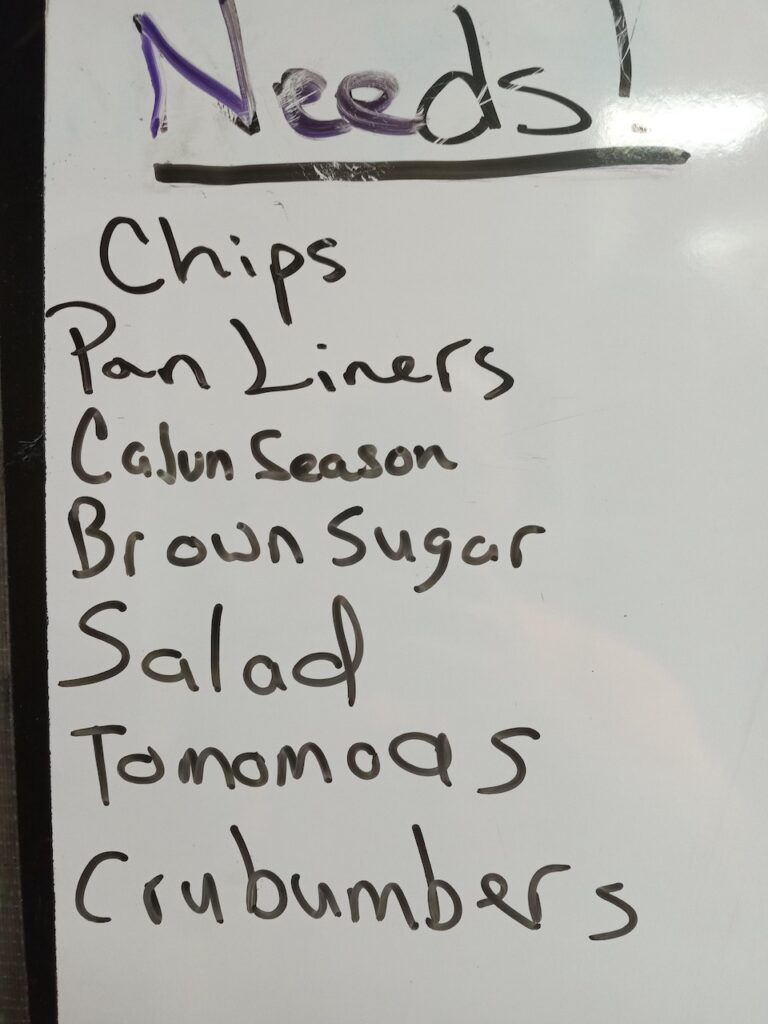

Blit Reward’s company kitchen shopping list.