- Do this now: Register for Hilton’s new promotion for 2,000 bonus points for every stay through April 30.

- The Bank of America Business Advantage Unlimited card has $500 sign-up bonus after $5,000 spend in 90 days. The card in its default state is 1.5% cash back everywhere, but in its boosted state, it’s 2.625% cash back everywhere. (See the next item)

- Bank of America has a tiered sign-up bonus for new business checking accounts when you apply through a small business banker:

– $1,000 bonus with $20,000 in new funds

– $1,500 bonus with $50,000 in new funds

If you bring $100,000 in new funds, you’ll earn Platinum Honors status which boosts earning on cash-back Bank of America cards tied to the same business. Note that new accounts can fast-track the status to avoid parking funds for a year, and note that you can churn these bank accounts and thus the fast-tracked status. There are rumors that the program is changing in May though, so #bonvoyed either way I guess. - Capital One has a 15% transfer bonus to Avianca LifeMiles through February 11.

- Spirit 90% off of base fares for travel on sale with promo code 90PCT for flights that depart on Tuesdays, Wednesdays, and Saturdays Between January 21 March 4 booked by tonight. A mini FAQ:

– Will Spirit still be around by March 4? Maybe, it’s iffy

– Will you get your money back if they’re not? Maybe, it’s iffy

– Will you find MEAB flying Spirit? That one’s not iffy

In case you’re wondering how many Tuesdays, Wednesdays, and Saturdays this sale covers: I counted, there are 17. But don’t worry, Spirit threw three blackout dates in there too, so, on-brand.

Happy Wednesday!

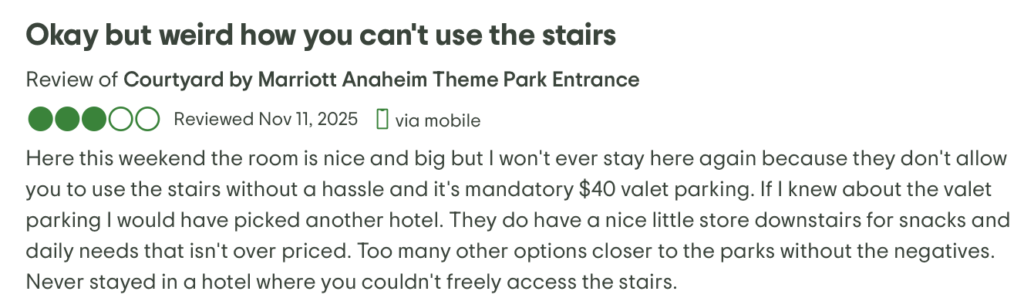

From the future: The remnants of Spirit airlines in December, 2026.