Introduction

Fortunately for everyone here, the MEAB staff worked, uh, let’s just say “tirelessly” over the holiday weekend to count ballots and choose the rightful winner for the first and possibly only annual MEAB Bonvoyed awards. These prestigious awards recognize recent ground-breaking accomplishments in anti-consumer policies in 2022 in all aspects of loyalty and travel, and while only the most insidious contenders were selected, rest assured there are legion runners-up in each category that we’d like to recognize, but we’re simply unable due to space-time continuum constraints (our flux capacitor is spitting out black smoke at 86+ mph).

Note: if you represent one of the following loyalty programs and would like a commemorative plaque for public display, please contact MEAB at your earliest convenience.

The Awards

Now let’s get to this years winners, the companies that best turned the industry’s “surprise and delight” into “surprise and despise”:

- In the “Bonvoyed Holiday Recovery” category:

Southwest Airlines, noted for its distinguished role in the Elliott meltdown for shutting down its phone lines and online chat support after canceling over a third of its flights. Why did they do this? Because who wants to answer all those angry calls anyway? 🎉

- In the “Bonvoyed Elite Benefit, Foods and Beverages” category:

Hilton, for upping its elite US food and beverage credit by $3 and raising the price of food and beverages by even more than that to make sure you’re still not getting as much as you used to.🎉

- In the “Bonvoyed Service, Prisons and Jails” category:

Hertz for wrongly filing stolen car police reports that lead to dozens of arrested customers, even though the cars were actually in Hertz’s care, or had already been re-rented out to the next

victimcustomer. 🎉 - In the “Bonvoyed Forum” category:

Flyertalk for making the site unusable on mobile devices thanks to 80% of the screen being obscured by ads, random scrolling events that are timed for exactly when you’re reading a key sentence, and for serving malware through its content delivery partners for multiple years — a proven track record dating back to at least 2012. 🎉

- In the “Bonvoyed Program, Marriott Bonvoy” category:

Marriott Bonvoy for devaluing their currency, removing their award chart, announcing they’re going to again devalue their currency next year, silently devaluing their currency again, and so much more. 🎉

- In the “Bonvoyed Bank, non-FTX” category:

Brex for wooing customers to help grow its business, raise it’s valuation, and to help it take on another round of funding… and then casting those pesky customers aside after deciding they’re just getting in the way of fleecing larger VC backed firms. 🎉

Fin

I’d like to thank our non-sponsor, Marriott’s Bonvoy, for not being involved in anything I do for everyone’s betterment. Our other non-sponsor, the defunct Nearside Business debit card couldn’t be reached for unknown reasons.

Happy Monday friends!

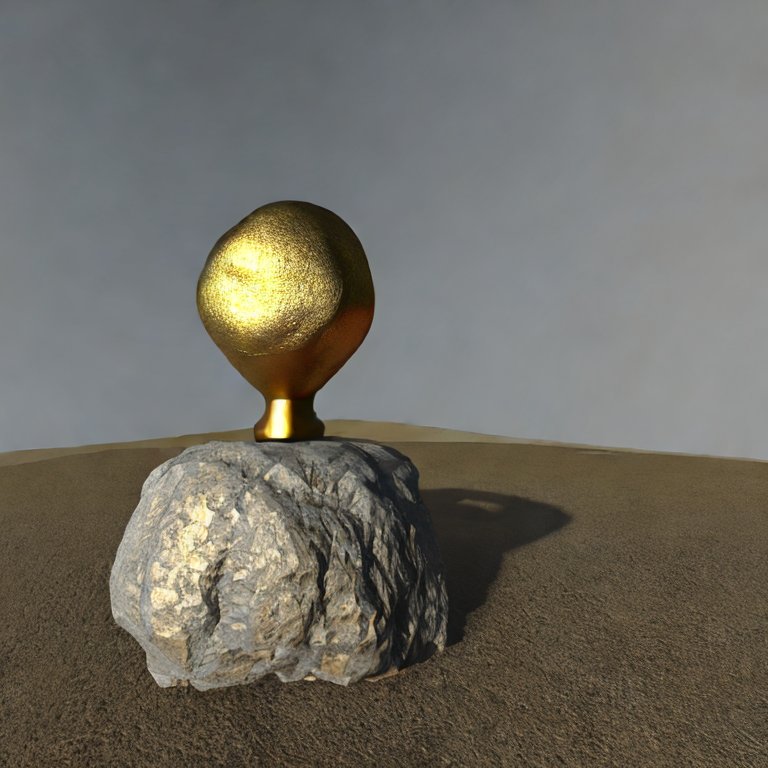

The prestigious MEAB 2022 Bonvoyed Award trophy: a deflated gold balloon representing diminished expectations on top of an unpolished rock representing an unpolished rock.