EDITOR’S NOTE: I’m on an annual blogging vacation for the last two weeks of the year. To make sure you still have content, some of the smartest members of the community have stepped up with guest posts in my absence. Special thanks to today’s author, a hilarious demi-whale with a penchant for writing, irieriley for writing this post. I’ll see you on January 1! If you’re interested in writing a guest post, please reach out!

If you’ve managed to find your way to this little corner of the Internet full of award hackers, manufactured spenders, degenerate gamblers, and various other scallywags, chances are you’re drinking from an uninterrupted firehose of information.

There is just so much content and media to consume (and that was even true before the era of AI slop), even in the churning space, that it can be difficult to stay on top of what’s going on.

Between public blogs, private groups, reddit, neverending Doctor of Credit comments sections and hundreds of pages of Flyertalk discussion on the proper Maldives soundtrack when flying to Conrad Rangali, it’s impossible to read everything.

I don’t think you should, either. If you only get your share of churning news from one source, you’re in the right place. Matt is very good at getting the point across succinctly (unfortunately, I am not), and understanding some references here requires reading between the lines. Some of the plays shared here and elsewhere aren’t spelled out 100%, whether for brevity, sensitivity, or both.

Due to this (and the general deluge of noise in the space), you likely find yourself skipping past posts and comments talking about cards you don’t have, airlines you don’t fly, and plays you aren’t playing.

In some cases, that makes sense. I care much less about Kroger than someone in Ohio. But when there isn’t a clear geographic or similar barrier to something, you’re likely making a mistake by not taking the time to understand the play. And sometimes, even geography doesn’t matter – as long as you “live, work, or worship here”.

Pictured: Vincent “irieriley” Adultman explaining his local business to a CSR at a credit union in Twin Falls, Idaho

Things change really fast in manufactured spending, and some of the most profitable things don’t last long*. The amount of plays I decided to ignore over the years because I wasn’t already doing it are up there with my penchant for calling my very-not suave self “Rico Suave” in high school in the annals of irieriley’s regrets.

While I believe you should do your best to understand an angle, there are definitely levels to it. If the DQ thread on reddit is delving into a trivial change to an Amex coupon benefit or Doctor of Credit comments are discussing free Hawaiian BBQ sauce, you can probably safely skip learning more, unless you really like Audible (or BBQ sauce).

But if you’re in a smaller community and someone is discussing the intricacies of how to complete a fuel dump mistake fare or how a new fintech fits into a liquidation strategy and you don’t understand the conversation, you should be trying to figure out why.

It may not even be a conversation – it could be an observation that you make yourself as part of probing and think to yourself why on earth does this need to be spelled out as company policy?

Some examples of things I’d probably want to look deeper into if I came across them and didn’t understand them:

- Why, oh why is MEAB’s favorite credit card a Sears store card?

- Why does a cash back fintech not pay out on certain vendors? And for that matter, why do they not pay out on a subscription to a churning podcast?

- Why does the Android app store say everyone who downloaded a different fintech’s app downloaded the app of a random credit union in Lubbock?

- Why are people talking so much about the timeframe for the 35% rebate on cash business fares booked with MRs via an Amex Business Platinum? I thought transferring was always the best value?

- Why does the new group I’ve joined talk so much about Costco gold?

It might not necessarily even be some big, hidden secret. If the blogosphere is to be believed, the slowdown on Amex NLL offers and continued prevalence of pop-up jail was probably one of the biggest negative trends of the year for the hobby.

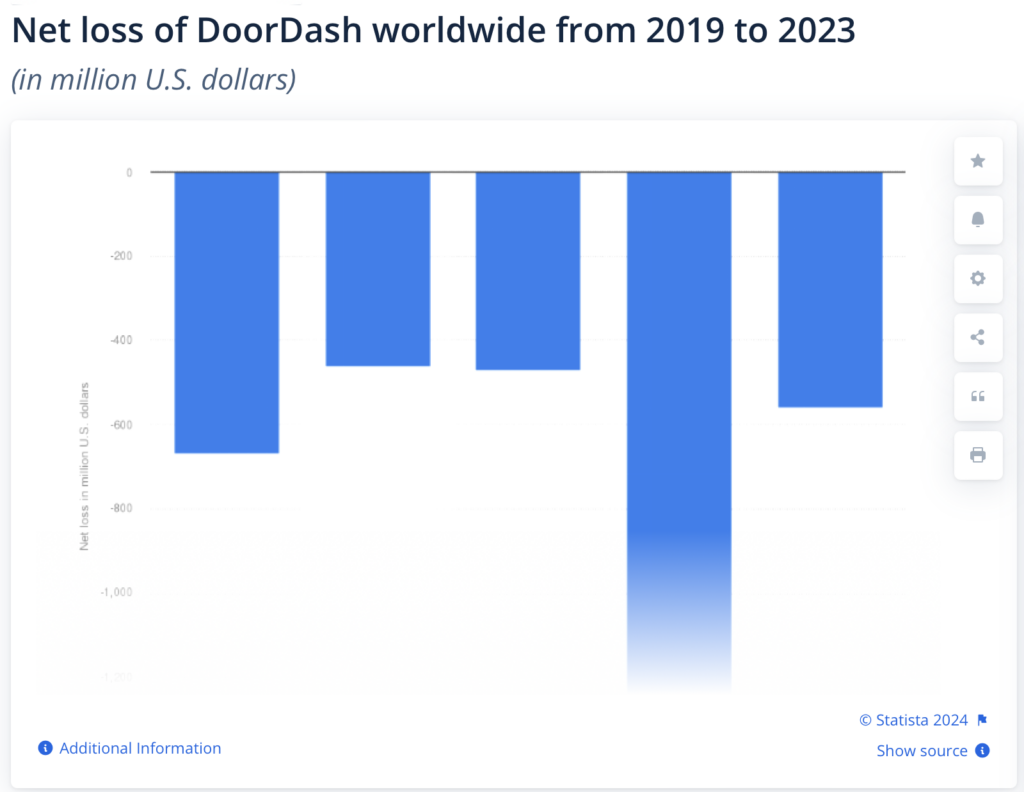

But I’d argue that the most negative news of the year, especially for our friendly cetacean population, is the cap on Schwab cash out and subsequent cap on 4x dining MR points on the Amex Personal Gold. There’s not much to parse through here – no need for a SUB when you’re a whale that’s gonna whale.

Ultimately, it’s up to you how much time you want to spend on this hobby. It can be like a full time job, but with the right knowledge, it can pay like one too. Sharing finds and data points and making friends in the community can go a long way towards finding your like-minded group of maximizers.

– ireriley

Pictured: a whale with a mentee regaling on the days when you could cash out $50k $44k of Membership Rewards points per week. No, I don’t know why it has both legs and a tail, and yes, I am extremely afraid of it.

*Footnote: While I am advocating for you to put more effort into understanding plays, I am not advocating for you jumping into a new play without doing your due diligence and assessing your personal risk tolerance. I regret missing a lot of plays, but I don’t regret missing Hardbody, The Plastic Merchant, etc.