No doubt you’ve heard from dozens or hundreds of sources about Silicon Valley Bank’s collapse, and while it looks like all deposits will be available and accessible, we can still learn something here.

First, let’s talk about some of the relevant ripple effects that we’ve seen over the weekend:

- Brex had account holders bring billions of dollars in deposits from Silicon Valley Bank, realized they don’t have to compete nearly as hard, and then immediately devalued their points: mileage transfers are now 1,670 to 1,000, statement credits are now worth 0.6 cents per point, and crypto buys are worth 0.6 cents per point (but their value could decrease even faster than inflation)

- Enzo ended its cash back program, including its 1% cash back debit card

- Plastiq suspended payments due to their reliance on Silicon Valley Bank accounts, and although probably not related to SVB, lost their agreement to IPO via the Colonnade SPAC

- Starting yesterday, depositors in wealthy neighborhoods were lining up at other potentially troubled banks worried that assets above $250,000 may be at risk

- Circle’s dollar-pegged USDC trading price fell 12% because the dollars backing USDC were at SVB

Next, we can project a bit about what will happen in our game based on these datapoints:

- Bank bonuses will become more important from a risk avoidance perspective for high net-worth individuals and businesses in case the next failure doesn’t have assets to cover beyond FDIC limits and the Fed’s new emergency fund doesn’t come through

- Banks will be more willing to offer bonuses in the short to medium term to win new high net-worth customers

- Credit card companies sign-up bonuses will probably go down because banks will want to increase their banking bottom line in the short term

- Big banks will offer more credit card incentives for deposit holders to keep them locked into the ecosystem (like BoA’s Premium Rewards program) – JPMC is a notable exception to this though

- FinTechs will be less rewarding as competition lags and the need to diversify banking partner risk increases

- Businesses and characters that need loans to continue may find themselves in a rough spot because long term financing prospects look hard and expensive

Blah, blah, blah, how about something immediately actionable poindexter MEAB? Fine, let’s get back to basics: Office Depot/OfficeMax has $15 back on $300 or more in Mastercard gift cards through Saturday. These are Metabank Pathward gift cards, so as always, have a liquidation plan in place (unlike Silicon Valley Bank, amirite?)

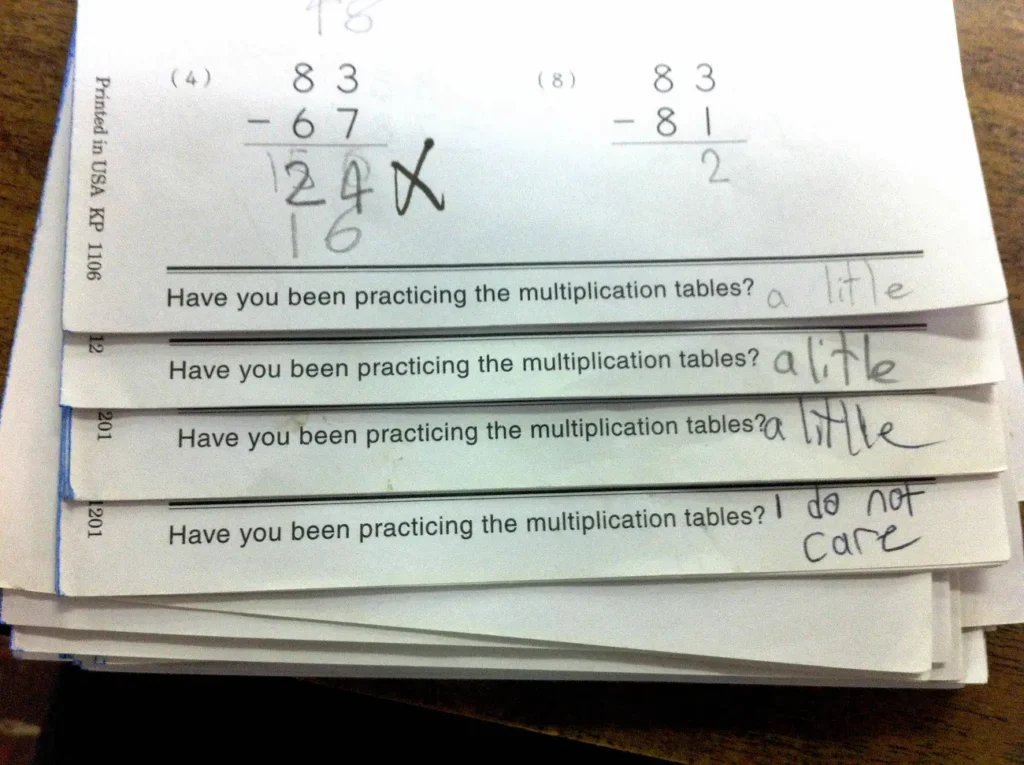

An excerpt from the Silicon Valley Bank rate hedging playbook.