UPDATE: Corrected off by 10 math. 🤦♀️

I usually try and order these items based first on how interesting I think they are, and second to try and group like things together(-ish). That was harder than normal today.

- The Capital One Spark Cash Plus has one of the more whale friendly sign-up bonuses that I’ve ever seen. The card’s bonus:

– $2,000 statement credit after $30,000 spending three months

– $2,000 additional statement credit after every $500,000 spent during the first year

– $150 statement credit to waive the annual fee after $150,000 spend

The base card earning structure is 2% on everything. Ignoring the annual fee credit, the sign-up bonus effectively adds: 6.67% extra on your first $30,000 spend and 0.4% extra on exact $500,000 spend increments after. For the math challenged, that’s 8.67% back and then 2.4% back on all spend with proper optimization. The second level hack is to pair it with a miles earning Capital One card to transfer the outsized earning into mileage programs. - The Capital One Venture X Business card has a heightened sign-up bonus:

– 150,000 miles after $30,000 spend in three months

Including the normal 2x earning, this card a 7x card for the first $30,000 spend. The $395 annual fee is not waived, but the card does include a somewhat gameable annual $300 travel credit. - Avianca LifeMiles has devalued and retooled award redemption costs. The major changes:

– US East to the United Kingdom is slightly cheaper in all cabins

– The rest of US to Europe awards are up 17% for Y, 11% for J, and 50% for F

– Continental US to Asia is up 33%

The booking engine and pricing engine both remain quirky and the typical weirdness largely still persists. (Thanks to AwardWallet) - The Citi BestBuy credit card, a future Unsung Hero (thanks to prodding by Derthsidious), has a few recent developments:

– There’s an uncapped 15% back in rewards on your first day through September 13

– You can redeem points for non-expiring BestBuy gift cards

The card has no-annual fee and it earns 3x on gas, and 2x on grocery and dining. If the landing page for the card looks familiar to another weird card, that’s because it’s a cousin to another Unsung Hero. - VanillaGift.com has fee free Visa gift cards through Saturday for back-to-school funzies with promo code VGBTS24. Purchase limits are $10,000 per account per rolling 24 hours, and note that American Express first party cards won’t earn rewards on this site. But that’s one of the many reasons we have non-first party AmExes, right?

These are Vanilla / Incomm cards which have liquidation throttles at most major chains for in-person transactions.

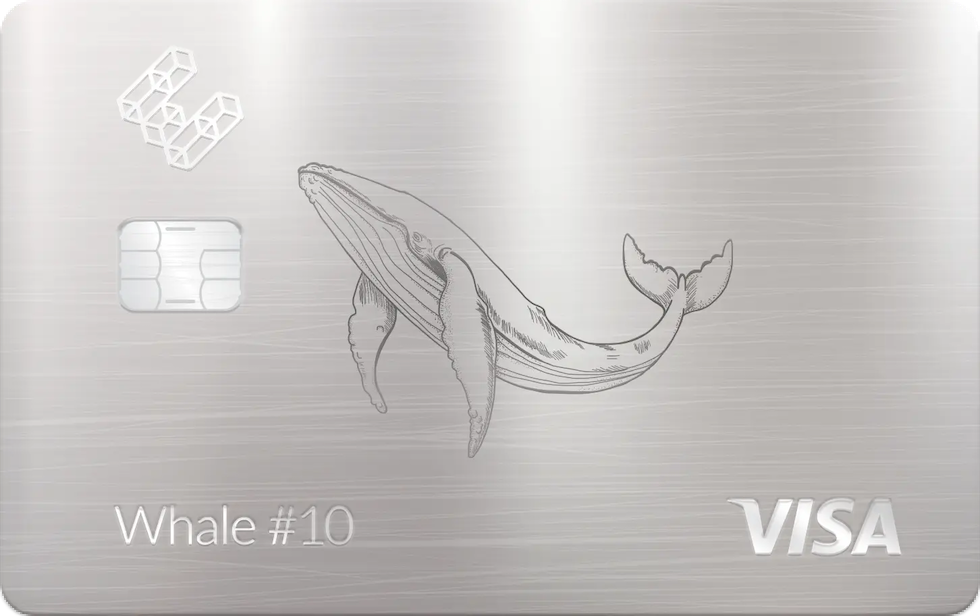

Rejected design for the Capital One Spark Plus card (sadly).