- Capital One Shopping has a widely targeted offer for $250 off of $250+, log in to your dashboard to see it. Note that some properties only earn $200 off of $250; I couldn’t discern a pattern on which was which.

Because no-one asked: P2 saw an offer for $50 off of $100+ at Birkenstock right below the hotel deal and was more excited by that. - Bank of America has an increased offer of 100,000 Atmos miles and a Global 25,000 point companion award on its premium Atmos Summit card after $6,000 spend in 90 days.

- The American Express Business Gold has a targeted no-lifetime language (NLL) link for 125,000 Membership Rewards after $15,000 spend in three months. If you’ve got a mailer you can probably do even better. (Thanks to Matthewtheswift)

- Office Depot/OfficeMax stores have $15 off of $300+ in Visa gift cards through Saturday. Remember:

– Even multiples get bigger discounts because math

– There are “everywhere” cards with lower fees but different liquidation methods

These are Pathward / BlackHawk Network gift cards. - Safeway, Albertsons, Vons, and other Just4U rewards stores have 10x points earning on Instacart gift cards through Saturday. Also on Saturday, you’ll probably earn 12x because 10x+4x = 12x.

The airline games stopped working for almost everyone else too by the way, not just you. - Raley’s, Nob Hill, and Bel Air stars have 15x points on Choice gift cards, some of which convert to Home Depot, through January 27.

- Qantas announced:

– No Emirates First redemptions without status starting February 18

– Emirates Business and First prices are increasing by 10%-30%

If there’s a good way to earn Qantas Status without flying on the airline or one of its partners, I don’t know it. - AAdvantage award redemptions on Aer Lingus metal is now working. Redemption rates using AA miles beat most of their other partners.

Happy Monday!

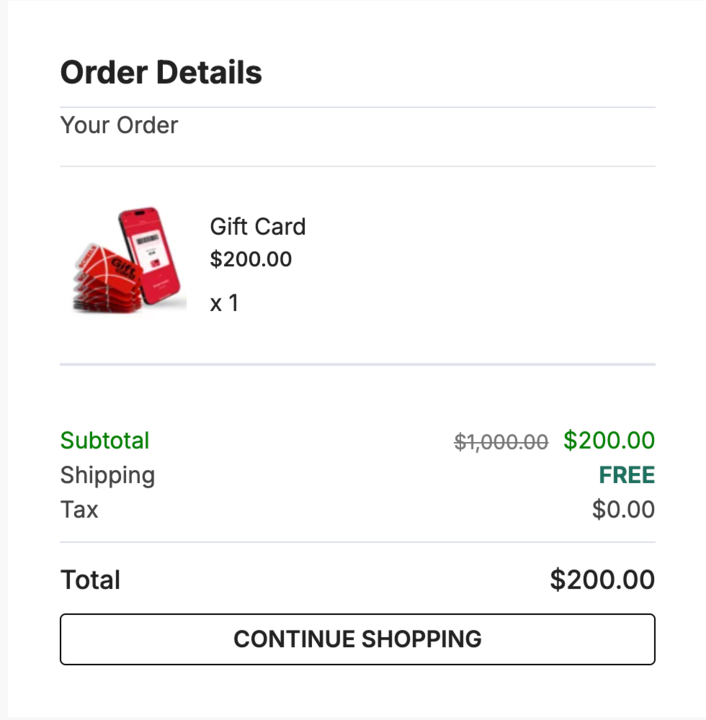

There’s also a gift card sale for $800 off of a $200 gift card, but it’s less exciting than you might think.

(Thanks to noahg)