EDITOR’S NOTE: Matt is on vacation until at or around January 1, 2026. Until then we have guest posts, today’s post is brought to today’s post is brought to you by the reader most likely to correct my math jokes (which I appreciate), John from Bank Account Bonus Central. Special thanks for the post!

People go to different places to get information about how to profit from banks, credit cards, brokerages, and other financial products to get cash and travel points. They look at websites, blogs, vlogs, YouTube videos, podcasts, Reddit discussion groups, and even pick through the garbage bins at the Hyatt in Lubbock, Texas, to get the profitable information they’re looking for. What if it were the banks that told you how to make money from them? This was my story, and it never gets old sharing what the banker told me about how to make money from them… so, I’ll share it again here.

I started as a customer of Washington Mutual. I got my mortgage from them, and eventually, things would sour for Washington Mutual, or WAMU, as they were called, and Chase grew their banking monopoly by buying up the remains of WAMU. I became a Chase customer over 25 years ago by default. I paid off my mortgage the Dave Ramsey way within 6 years of getting it and I sent them my direct deposit without them paying me anything to do so.

About 8 years ago, I was looking up different things online and found an advertisement that, little did I know, changed the direction of my life. The Advertisement was from Chase Bank and promised a $300 bonus for NEW checking customers.

I was NOT a new customer, but I was curious about this bonus and if there was any way that I could take advantage of it. I went in person to my local Chase branch and asked my local Chase Banker about this $300 bonus. I was promptly told this bonus was for “New Customers Only”. I said, “You are paying new customers $300, what do you have for loyal customers?” I was promptly told, “Nothing”. I followed up with, “Well, what value do you have for loyal customers?” She told me, “None.”

I followed up with, “How do I become a new customer if they have all the value?” I was told, “Close out your account and return in 90 days.” I asked, “So, you will pay me $300 to close out a 20-year-old checking account?” She said, “Yes, that is how we do business at Chase.” I said, “Perfect, close down my checking and savings accounts.”

I returned 90 days later and opened up a new checking account for the $300 bonus, and sure enough, I got my $300 bonus about 3 days after my direct deposit hit. I asked the banker, “What else do you have for new customers?” The banker replied, “Open up a savings account and get another $300.” I opened up a savings account and got $300. My wife also opened up a savings account and got another $300. I then asked what else they have for new customers. I was told that if I upgraded my checking account to a Sapphire Checking account, I would get another $600 bonus. I said, “Sign me up.”

I made $1,500 in short order from Chase as a “new customer.” I started researching who else values new checking customers. I quickly learned that almost every bank and credit union values new customers and doesn’t give a second thought about their existing “loyal” customers. I have devoted myself to being a “Professional New Customer” for the rest of my life. I am not only a “Professional New Customer” but also teach as many people as are willing to participate in this fun and profitable game.

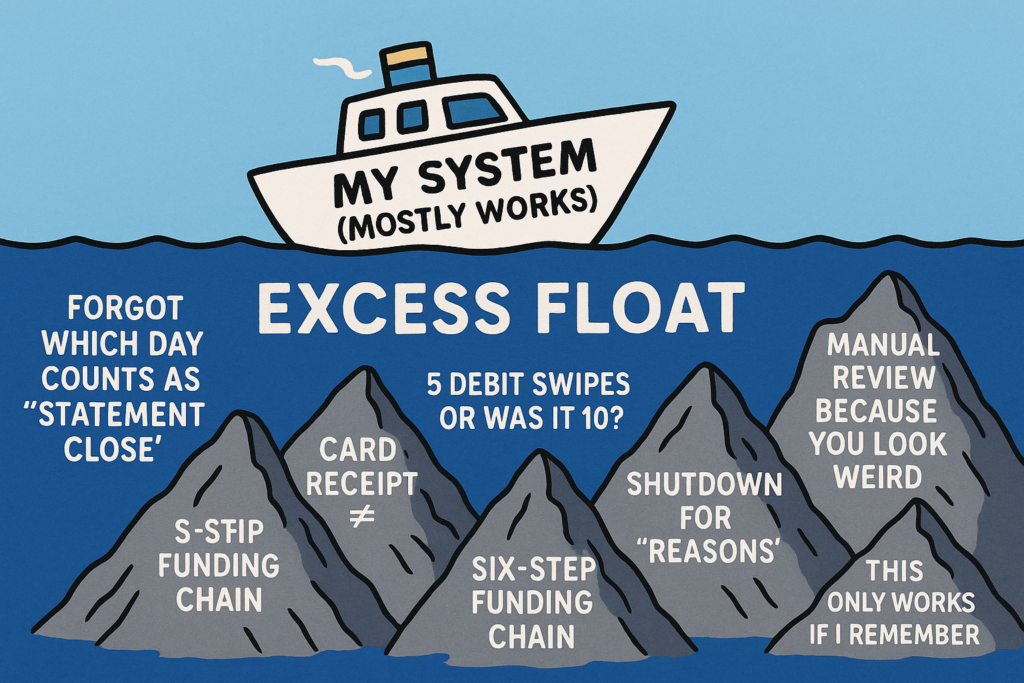

What does this have to do with a blog about traveling? As mentioned, bank points can be converted to either cash back or travel. In 2021, my family spent over 1 million in Chase UR points on resort vacations. The mindset is not too different between either team cash back or team travel. I am currently a high school math teacher looking to buy the most expensive thing in my life: my retirement from the public education system. Ultimately, this hobby seems more and more like a video game. So many accounts can be opened, and cash and points received without any human interaction. Simply push the right buttons on a keyboard. Who knows, the garbage bin at the Lubbock Marriott may have even better info than what is offered here. As you can see from the picture below, the bank vaults are full for both new customers and for repeat new customers.

Let’s make 2026 more profitable than 2025! Let the Churning Adventures continue!

– John, BABC

It may look like a bank vault, but this is John’s washing machine.