- There’s now a public, safe version of an upgrade link to a Business Platinum for Business Gold and Business Green American Express card holders with 120,000 bonus Membership Rewards after $10,000 spend in 90 days.

This one is safe for anyone to use, potentially unlike the one made public last week which was dubious at best and err, scary at worst. Why was that one dubious? It was a manufactured link specifically constructed with two contradicting offers that happened to pass through the application system in an unintended way. Side-note: That fact that this link is dubious still isn’t noted on other blogs, hopefully because they just don’t know. Always know the province of links before diving in. (Thanks to reb702) - Southwest has a 40% fare sale for selected flights booked by tomorrow night for travel between October 29 and January 31, 2025 with the typical blackout dates that you’d expect using promo code SAVEWOW.

I got approximately 25,000 Rapid Rewards points back by grooming by existing bookings, though most of those existing bookings are backup flights so the expectation value for my actual cost is lower than 40%. - Marriott Bonvoy has a transfer bonus of 15% to AirCanada Aeroplan miles through the end of October. Points transfer at a 3:1 ratio and if you transfer in 60,000 point increments you get a bonus 5,000 miles too, which means you’ll earn:

(60,000 * 115% * 1/3) + 5,000 = 28,000 miles

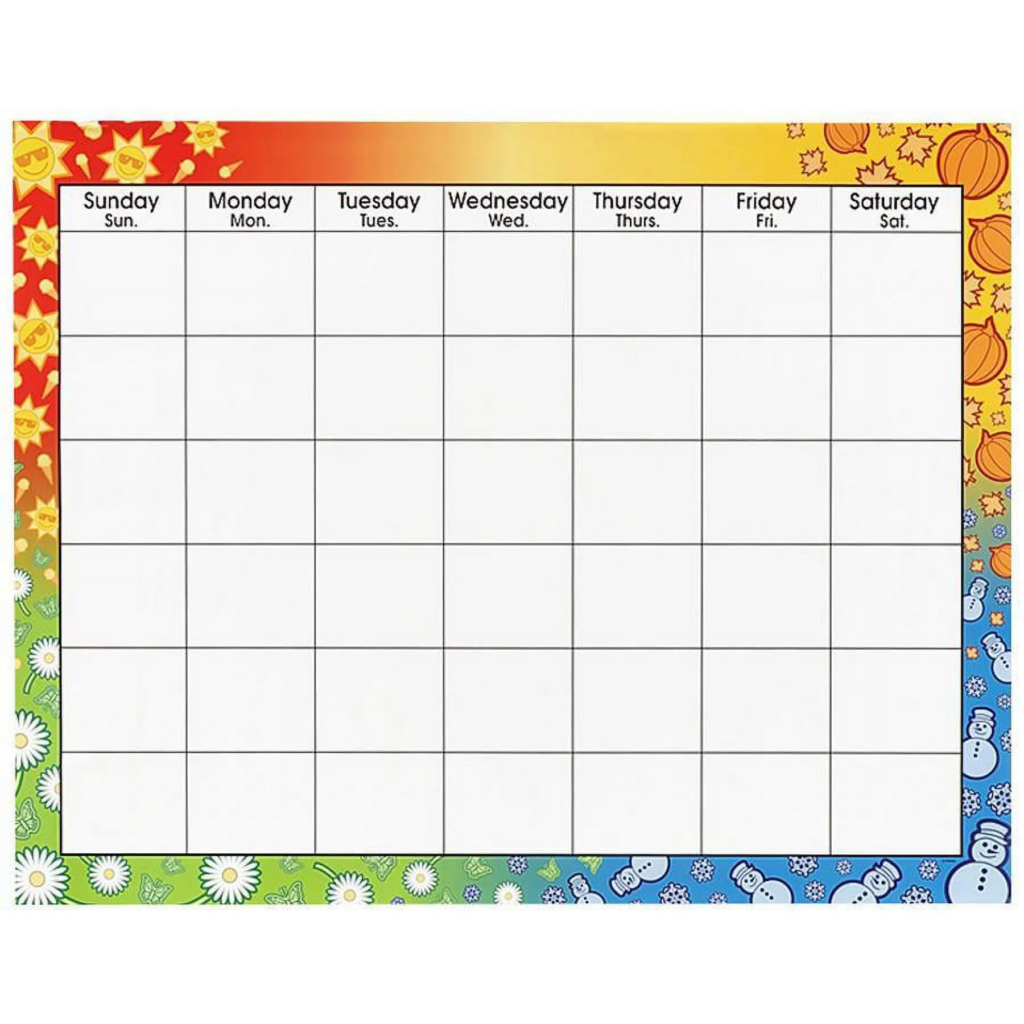

Which increases the normal transfer ratio to 2.143:1. (Thanks to TheSultan1) - AirFrance / KLM’s FlyingBlue program has released its promo awards for October for travel through March 31, 2025 to and from Europe. US cities include Dallas, Austin, Houston, Los Angeles, Atlanta, Miami, Chicago, and Detroit. US-lite cities include Havana and Toronto.

There’s a ton of economy space at 15,000 miles in this month’s drop, more than I’ve ever seen in-fact. Discount business class space is almost non-existent this year and barely-existent next year. - American Express has 100% off of purchase fees with promo code 100AMEXGIFT. The main use for these is shifting spend to a later time while earning the sign-up bonus now, but only if your manufactured spend-fu can’t support immediate spend needs. (Thanks to GCG)

Calendar view of discount business class inventory in this month’s FlyingBlue promo awards.