Introduction

The continuous need to feed the content monster occasionally means every related blog out there writes about the same thing. This week’s President’s Day version hit with the news that United TravelBank hasn’t been reimbursed for American Express airline incidental credits since about 10 days ago.

Analysis

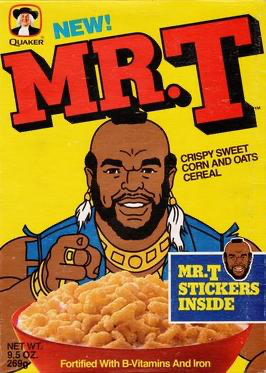

Mr. T and I share a lot of common beliefs about churning, and this event was no exception. I interviewed him for more insight (special thanks for taking the time out of his busy schedule to chat):

[MEAB]: Is it actually broken?

[Mr. T]: It might be, fool! Or it might not be. Nobody knows yet.

[MEAB]: Has this happened before?

[Mr. T]: Yes, I seen this movie before! :Late 2020, in early 2024, and in late 2024. This ain’t our first rodeo.

[MEAB]: How many times has it been declared dead?

[Mr. T]: In the last day? Or you talking lifetime? Either way, a whole lot.

[MEAB]: If it is dead, is that the end?

[Mr. T]: There are other options even for Newark and San Francisco chumps. I pity the fool who doesn’t think so!

[MEAB]: Should I use other options ASAP?

[Mr. T]: Unless you gotta close that card down in a couple of weeks, how about just sit tight and see how it shakes out?

[MEAB]: Should I write my own 2,000 word post declaring it dead?

[Mr. T]: Only if you stretch first, that’s a lot of reaching!

Have a nice Tuesday, and “never dig a grave before the deal’s even cold”.

Next up: Turning American Express Airline Incidental credits into cereal.