EDITOR’S NOTE: I’m on an annual blogging vacation for the last two weeks of the year. To make sure you still have content, some of the smartest members of the community have stepped up with guest posts in my absence. Special thanks to Cashback Cowgirl for authoring this post and for her alternative viewpoints on churning. I’ll see you on January 1!

* Disclaimer: I am not a financial advisor and this is not financial advice whatsoever. These are just my own opinions and personal preferences I am sharing. Tax implications vary by individual.

Most of us agree how important it is to have an emergency fund — it’s often one of the first recommendations from financial planners along with tracking all of your spending each month. A three to six month emergency fund recommendation is common. Some of us, including myself prefer a one to two year emergency fund, or more. It depends on a lot of factors: risk level, type of employment, number of dependents, personal preference, etc.

In the recent past, many of us who prefer a larger emergency fund have been concerned because that money was not getting much interest — just sitting there eroding. Just a couple years ago it was hardly getting anything as interest rates were near zero. So many of us opted to just put all we had into the S&P 500.

Today, at this time of writing 4%+ APY is fairly common — around 5% just a few months back. So things have changed quite a bit.

Well even better, is that if you are in the bonus hunting game, that emergency fund can also serve as a bankroll for the bonus hunting. It then becomes dual purpose: both a bonus hunting bankroll as well as an emergency fund. I call this the BHEF — the Bonus Hunting / Emergency Fund.

Bonus Hunting. For the purposes of this article, let’s define bonus hunting as any income activity related to:

- Deposit account sign up bonuses

- Brokerage account sign up bonuses

- Credit card sign up bonuses

- Cashback rewards — both credit and debit cards

- MS related activities

Beating the Market. Personally, I am finding that I am beating the average market returns with the money in my BHEF — by quite a bit actually — often at 10-28% APY for large bank sign up bonuses and solidly 16-33% with MS related activities (IYKYK).

Size of BHEF. I have enough of a BHEF right now that in addition to it functioning as a bonus hunting bankroll it also functions as a 31 month emergency fund. My goal BHEF will perhaps end up functioning as 75 month emergency fund.

I am currently making my 31 month BHEF work for me getting 10-33% APY with it.

My BHEF is not too large, but large enough to simultaneously take advantage of the larger juicy bank account sign up deals — e.g. invest $20,000 for 60-90 days and get $1,000 (BofA Business Advantage Checking) & invest $30,000 for 60-90 days for $1000 (BMO) — along with plenty of MS.

So for me there is no penalty having this large of an emergency fund, since I am beating the average market returns handedly, tax implications included*. It’s very satisfying that no matter how the market performs or if I lose my income, I am good for several years.

BHEF Formula. I don’t count credit card float as part of my BHEF — whether that be introductory 0% APR float or the monthly 30-50 day float. However, even though I don’t count float as part of my EF, I still use it as a tool when I can as part of my bankroll gaining 10-33% APY on it.

For me my BHEF is the following simple formula:

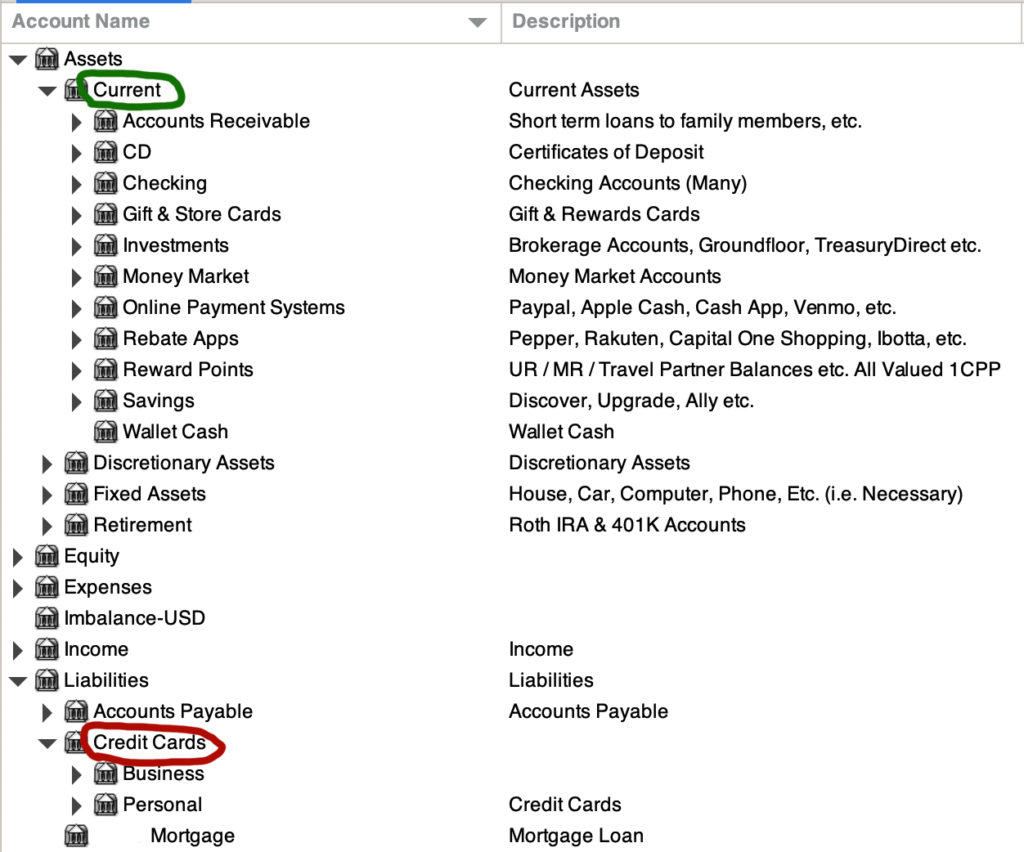

Current Assets – Credit Card Debt = BHEF

Current Assets for the most part are very liquid and spans dozens of accounts. My Current Assets include Accounts Receivable, Certificates of Deposit, Checking accounts, Gift & Store Card Balances, Investments (Brokerage Accounts etc.), Money Market accounts, Online Payment Systems balances, Rebate App balances, Rewards Points, Savings accounts and Wallet Cash.

The following is a screenshot of my Gnucash bookkeeping tree. It shows the breakdown of Current Assets and Credit Cards. The credit card debt is divided into two sub-trees: business and personal. [It’s handy to separate the credit cards into these two sub-categories since only the personal credit cards show up on the personal credit report allowing me to quickly observe my total personal credit utilization (PCU).]

Accounts Receivable is never more than say $1500 (in short term loans only) and Accounts Payable is never really more than say $100 which I pay off each month — e.g. reimbursing boyfriend for buying something for me with his cash like at a grocer which only takes cash (Winco).

I can quickly see what my current BHEF is by looking at the two circled numbers below in my Gnucash software — a simple subtraction.

Security. This bonus hunting game for me has been a blessing. Not only do I beat the market, I have multiple years of security. I am good if I need to replace the roof or do some other major home repair. I am good if I have to replace a vehicle, etc. — paying for them in full, no financing.

Low Risk. In my opinion, there is virtually no chance for me to lose money with the BHEF unlike with investing in the stock market, which could have gigantic losses / corrections at any moment. 10-33% year over year annual returns with very little chance for loss on an EF is quite appealing! *

Too large of BHEF. At some point though the BHEF gets large enough to where it makes sense to perhaps use the excess to say fast pay a mortgage or perhaps invest in something like an S&P 500 ETF. It all depends on one’s financial goals. After I have reached my BHEF goal, I’ll be investing the excess into S&P 500 ETF. We’ll see after I reach my 75 month BHEF goal how well I can make it work for me — if it beats the market handedly who knows I may increase the size of my target BHEF.

Plans. I plan on never having to touch the money I put in the S&P 500, having my BHEF to fall back on. My personal plan is to keep my BHEF topped off, continue bonus hunting for the rest of my life, and put all the monthly excess blindly into the S&P 500 completely ignoring the market news and never selling it unless I need to harvest capital gains (or losses) to reduce tax liability.

I might consider buying dips in the market, if I am feeling cute and my BHEF is maxed out, but I’d have to weigh the risk of reducing my emergency fund during a recession in that moment. I personally will not risk more than say one third of my maxed out emergency fund when buying a large dip.

Summary. A large emergency fund perhaps isn’t a bad idea at all if you can make it work for you, for example with the bonus hunting game. (I also plan to max out my 401k/IRA as well each year.) A BHEF also perhaps makes MS a bit easier having a bit more flexibility when managing float.

Afterthoughts. A portion of a very large maxed out emergency fund could also be useful sometime in the future as part of a down payment on a home — if the occasion arises and there is real need for it.

Clarifications. When I say I am getting 10-33% on my BHEF with bonus hunting, I am referring to the large chunk of assets that would of otherwise gone into say the S&P 500. I am not including the gains from say very active MS loops which alone (with just float) can result in obscene amounts of % annual return.

– Cashback Cowgirl