- Do this now: Enroll in the new American Express Platinum and Business Platinum credits and hotel status boosts, and use quarterly benefits like Lululemon and Resy credits before September 30.

- The Chase Southwest Performance Business Visa card has an increased sign-up bonus of 120,000 Rapid Rewards after $10,000 spend in three months with a scheduled end date of October 22, and will probably be available via referrals by Monday. As long as you apply next month and wait until January to finish your minimum spend, this will be a Companion Pass valid for the lesser of:

– 24 months

– When Elliott management decides to kill the Companion Pass

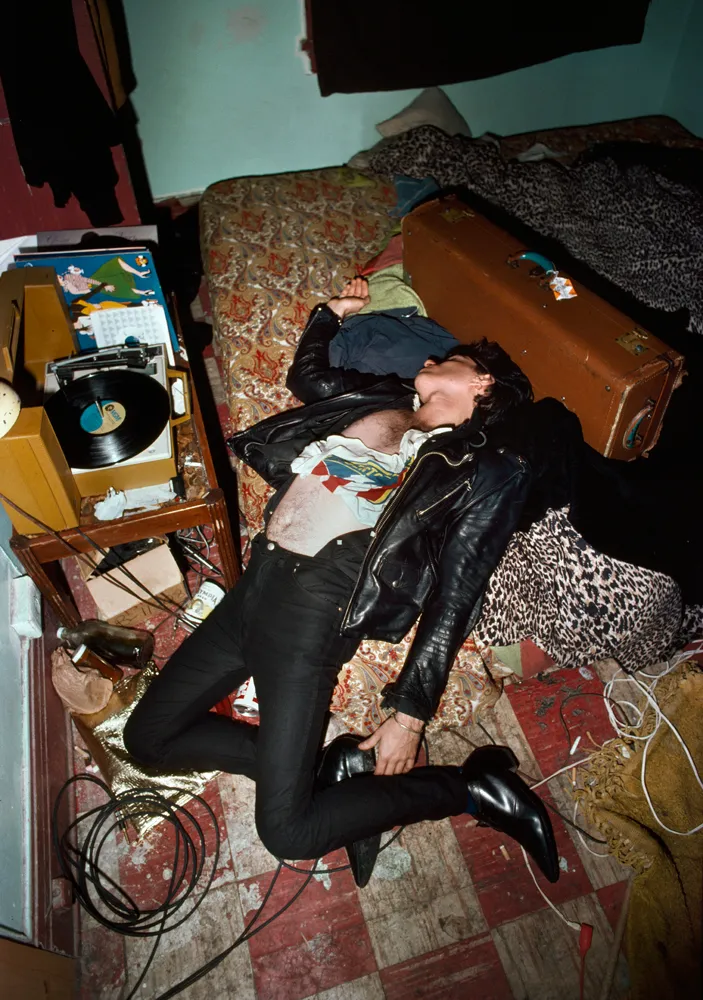

What’s the downside? Well, not only will you be flying Southwest, you’ll be flying the new Southwest. - Meijer MPerks has a promotion for 50,000 points with the purchase of most third party gift cards including Best Buy through September 30. There’s a limit of 50,000 points per MPerks account, but you don’t let that nuance stop you, do you?

Best Buy gift card resale rates are currently hovering at around 94%. - Kroger has a 4x fuel points promotion on third party gift cards excluding Amazon and fuel services cards, through September 30. There’s a similar promotion for fixed value Visas and Mastercards, but I’d stick to the online version of those for 5% back through Saturday.

Something something Best Buy something something. - American Express changed a couple of additional items with yesterday’s refresh:

– There’s a mostly worthless Oura ring coupon: $200 off

– The digital entertainment credit is now $25 monthly

– The Business Platinum has an offer of up to 300,000 Membership Rewards with the right gyrations (vpn/incognito/mobile/clown), including via referral – this link might work too but you won’t get a referral bonus

– The Morgan Stanley Platinum and Charles Schwab Platinum cards have increased bonuses of 125,000 Membership Rewards after $8,000 spend

You can get the old generation of the Oura for $200, but I’ve got great odds that it’ll end up in the trash or a junk drawer in a couple of months. (Thanks to Holly) - Chase tweaked its Sapphire Reserve cards’ hotel benefits, but neither starts until 2026:

– One time $250 credit on two night stays at some hotels booked through the Chase portal

– Each $250 “The Edit” credit, which isn’t the same as the previous credit, can be used any time through the year

Have a nice weekend!

The new Southwest.