UPDATE: Apparently Pepper’s coding has reverted to its original Computer Supplies MCC, so move along, nothing to see here kid.

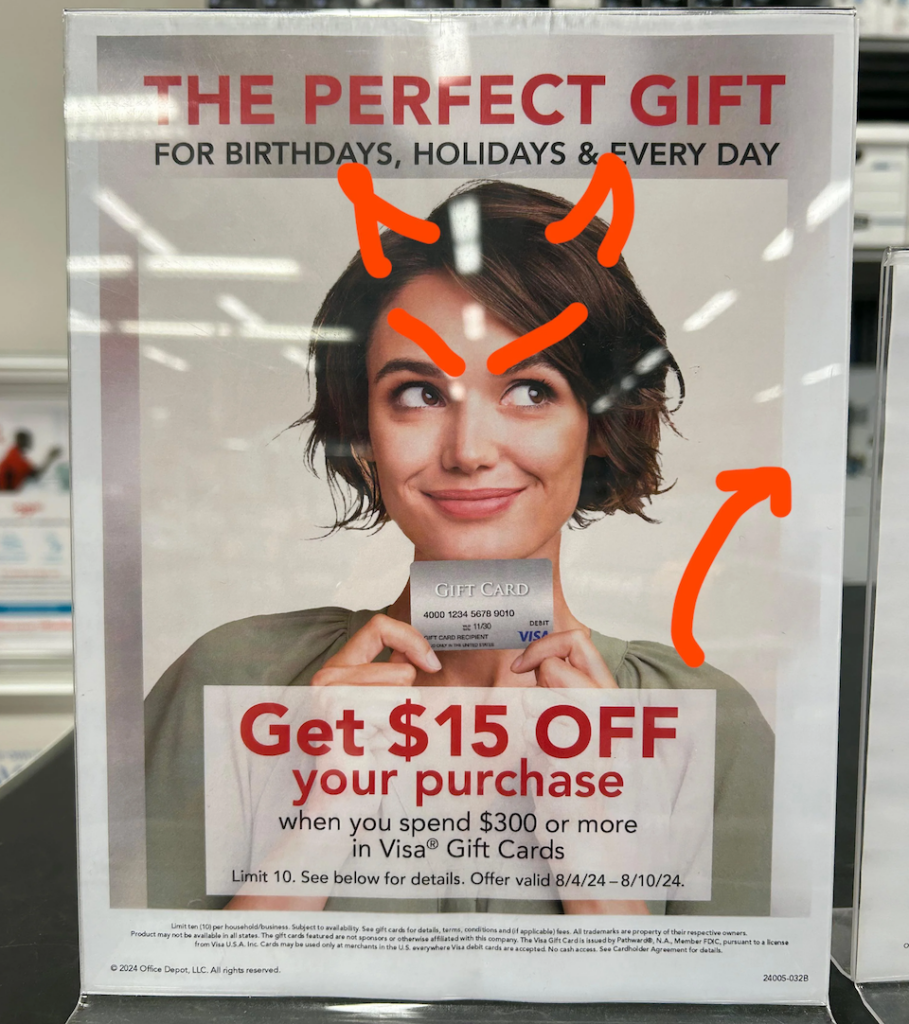

The Pepper gift card buying platform, one of the best vehicles in 2024 for transferring money from venture capitalist bank accounts to resellers wallets, had a change to its merchant account coding on Saturday: Charges are no longer showing as “Merchandise & Supplies – Computer Supplies”, but rather “Merchandise & Supplies – General Retail”.

Reportedly this change was intentional and forced on Pepper, and it won’t be reverted anytime soon. That means:

- American Express Business Gold cards won’t earn 4x

- American Express Business Platinum cards won’t earn 1.5x

- Bank of America Business Advantage cards won’t earn +3x for Computer Services

That doesn’t mean the game is over, but it does mean that the game has shifted to cards which have a high overall payout for general spend, and potentially for cards like the legacy Citi AT&T Access More or the Bank of America Customized Cash personal card. Of course, cards that can earn extra by looping FinTechs might be good replacements too.

Good luck!

Live view of Pepper’s internals.