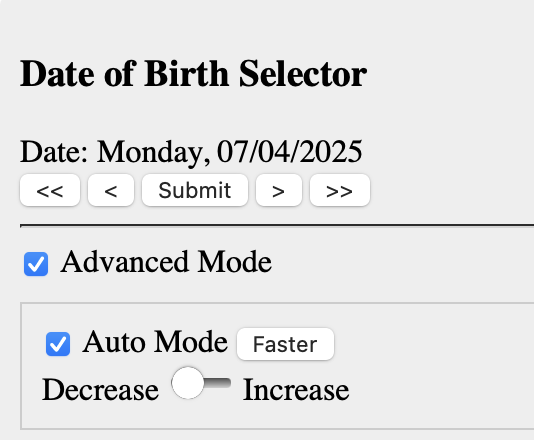

- Meijer stores have a digital coupon for $10 off of $150+ Mastercard gift cards through Saturday. This is probably the type of coupon that can be reclipped after each use, but multiple MPerks accounts are an alternate way out.

These are Pathward or Sunrise gift cards, and if you have a good liquidation channel this is the kind of deal that can make sense to travel from out of state too. (Thanks to Jonathan) - Meijer stores have $50,000 points with a $500 third party gift card purchase through May 10 (excluding Amazon and phone cards), limit one per MPerks account.

BestBuy, Home Depot, and Lululemon are great candidates for scaling this one as the market recovers from being high in a Pepper induced coma. This deal can also make sense for out of state travel, but Pepper makes it slightly less so than typical. - Bilt has a tiered transfer bonus of 25%-100% to Southwest Rapid Rewards on Thursday. I can’t find any limit, but I’d be surprised if there isn’t one and it’ll probably be 100,000 points or less.

Apropos of, let’s say, nothing: What’s better than one mediocre company? Two mediocre companies working together! - Brian M notes that Southwest has new targeted promotions for bonus mileage earned on paid tickets. Brian’s example bonus was +60% earning for A-List members (that’s +35% over normal).

You can check your promotions at this link. - Speaking of Pepper, I’m still waiting for things to stabilize for at least a couple of days before the next full update. There’s enough for another short-form cluster hug though:

– Coin redemptions were down for the weekend and continue to be offline, but apparently will come back (?)

– Buying gift cards was down part of the weekend

– Coin rebate rates on most brands have dropped to the uninteresting range

– You can’t buy Amazon or Sams Club gift cards at all

– Coin rebates now come in four days instead of two weeks

So, you know; typical Pepper.

Coming out of a Pepper induced coma looks fun, right kids?