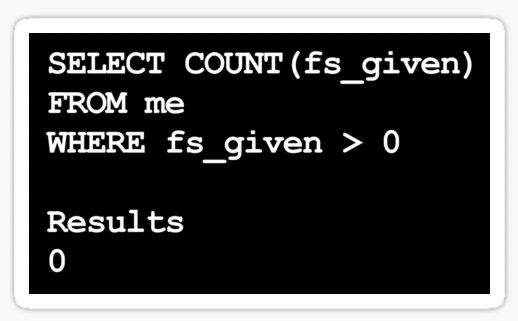

- American Express has newly targeted offers for the Delta SkyMiles cards, and they’re pulling up different offers based on the browser used, device type, IP address, and probably the last type of beverage you had. The best offers seem to be:

– Personal: Gold 80,000 SkyMiles, Platinum 90,000 SkyMiles, Reserve 100,000 SkyMiles

– Business: Gold 90,000 SkyMiles, Platinum 110,000 SkyMiles, Reserve 125,000 SkyMiles

Both the personal and business gold cards have a waived first year annual fee. (Thanks to FM) - Hilton for Business has a relatively lame tie-in with Delta Skymiles for Business: Enroll in SkyMiles Business with promo SM4BHLTN by August 31, link your Hilton for Business account, then book and fly a revenue flight in 90 days to receive a $50 Delta eCredit.

- Raley’s, Nob Hill, and Bel Air stores have an unadvertised promotion for 15x points on Choice cards through Tuesday. If these stores sold electronics this could be a deal of the year, but instead it’s effectively just a discount hot dog machine.

Obviously some Choice cards are better than others, but if you’re lucky you’ll find some that convert to BestBuy and Home Depot, both of which are currently reselling at 93%+. (Thanks to Bill) - The MooMoo brokerage, one of only four US brokerages founded and operated by cows, has several stackable promotions:

– Tiered NVDA stock worth up to $1,000 for brining up to $50,000 in new money and holding for 60 days

– 8.1% APR on up to $20,000 in a cash account for 90 days, then 4.1%

– An ACATS match of 3% on up to $20,000 in transferred stock held for at least 60 days

– $40 back at several portals for a new account

Believe it or not, this is on the simple end of MooMoo gaming. (Thanks to DoC)

Have a nice weekend!

Hot dogs from a discount hot dog machine.