1. Still waiting on your American Express Platinum Clear $179 credit? Or maybe, you’ve got way to many of them like me? Well, there’s a slightly better membership deal that surfaced on reddit: Sign up at clearme.com with promo code AUG129GIFT and you’ll get a $50 discount and a $15 Amazon gift card, which is slightly better than what you’ll get by using a United or Delta general member discount. (Thanks to deakmania)

2. Point.app has a new streak going: Get 3,000 points or $30 back after using your card once a day for five days before August 20, though the sum of the purchases have to be greater than $200 for the streak, a 15% return on spend. (Last round it was $100 in total purchases, and earlier this year it was $5, so the trajectory is going super-lame.)

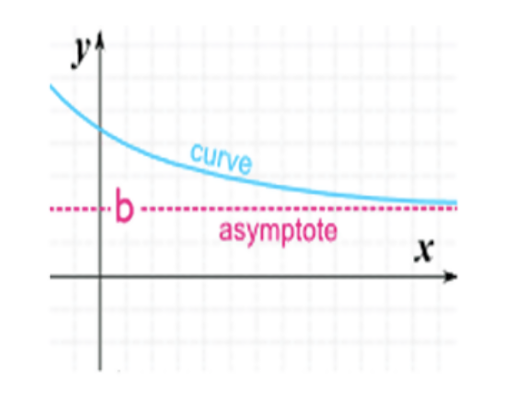

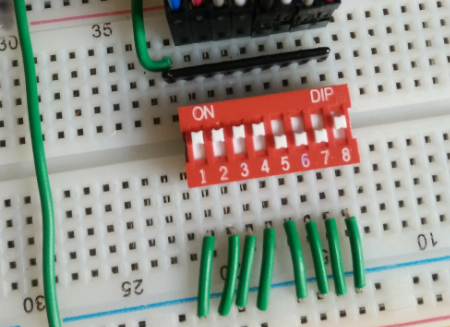

I’ll play this by setting up debbit to do an Amazon reload randomly between $40.00 and $41.00, once a day for 5 days. To help push some of you over the hump for debbit, here’s my config.txt for this one (obviously, you’ll have to put your own username, password, and Point card number in place of the ones in my stanza. Then, set a reminder on your phone to kill debbit in 5 days and remove this configuration block so it doesn’t keep spending.

point_debit_card:

amazon_gift_card_reload:

total_purchases: 20

amount_min: 4000

amount_max: 4100

usr: [email protected]

psw: SUPER-SECRET-PASSWORD-MEAB-RULES

card: XXXXXXXXXXXXXXXX

min_day: 2

max_day: 20

burst_count: 1

spread:

min_gap: 86400

time_variance: 180If you’re new to Point.app, make sure you sign up with a referral, which will pay you and the referrer $100 after spending $1,000 (I don’t know of a better referral at this time, though referrals of up to $250 have existed in the past).

3. The Daily Churn podcast did an interesting, detailed episode on an Interactive Brokers sign up bonus. The podcast’s main argument for why this is a great bonus is because the payout is prorated based on how much money or stock you transfer in, rather than having fixed bonus thresholds. Your best bonus under a single player scenario will be $1,000, and under a two player scenario it’d be $2,200. This could be a nice way to move your 401(k)s or IRAs to a low-fee broker and get a bonus for doing it.