MEABNOTE: I’ll be going on a blogging vacation at the end of the year and there won’t be any daily posts between December 15 and December 31, at least none from me. We may have guest posts during that period, but that depends on you sending me some. On January 1(ish), we’ll celebrate with the 2025 version of Travel Hacking as Told by GIFs.

- The Delta personal and Business American Express cards have new public no-lifetime language (NLL)[EDIT – link corrected] links, also available from your Delta Business portal’s dashboard:

– Business Reserve: 125,000 SkyMiles after $10,000 spend in six months

– Business Platinum: 110,000 SkyMiles after $6,000 spend in six months

– Business Gold: 90,000 SkyMiles after $4,000 spend in six months, annual fee waived

– Reserve: 100,000 SkyMiles after $6,000 spend in six months

– Platinum: 100,000 SkyMiles after $5,000 spend in six months

– Gold: 85,000 SkyMiles after $4,000 spend in six months, annual fee waived

The Business Gold card with its waived annual fee is a current sweet spot in the American Express portfolio. If you can get these via referral and games, that’s likely still a better option though. (Thanks to achzeet44) - The Cardless issued Qatar Privilege Club Visa cards have heightened sign-up bonuses through February 4, 2026:

– Signature: 20,000 Avios after one purchase and 45,000 additional after $3,500 in 90 days

– Infinite: 25,000 Avios after one purchase and 75,000 Avios + 150 QPoints after $6,000 spend in 90 days

Both have 6x earning at dining through February 4, but beware of behaving like a floosie on Cardless cards if you value your relationship with the bank. - Staples stores have fee-free Visa gift cards through Saturday, limit nine per transaction.

These are Pathward / BlackHawk Network gift cards. - Stop & Shop, Giant, and Martins have 3x point earning on Mastercard gift cards through Thursday, limit $2,000 per loyalty account (or limit $1,500 for Giant Food because it’s still a running joke at the parent company).

Stores carry either or both Pathward / BlackHawk Network gift cards and Sutton / Incomm gift cards.

Happy Tuesday!

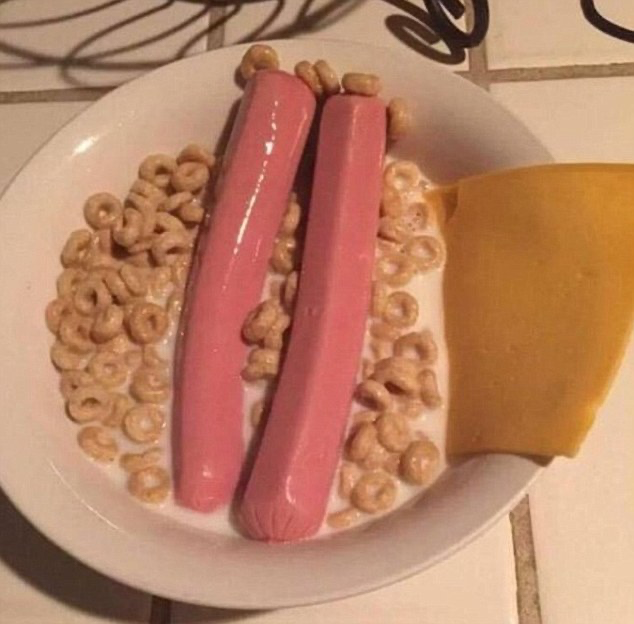

Giant Food stores get joke sushi too.