- Yesterday (and if you’re lucky still now), SoFi Banking had a bonus of $400 or 40,000 Membership Rewards on Rakuten, in addition to a $325 sign-up bonus from SoFi with $5,000 in direct deposits.

If you already have a SoFi account, maybe this is a good indication that it’s time to close it to set yourself up for the future. - Kroger has a 4x fuel points promotion on third party gift cards excluding Amazon and fixed value Visa and Mastercards gift cards running through Tuesday, August 12. The big brain play here is gift card reselling, but there’s a slightly less big brain play made popular on reddit a few days ago too.

- Alaska is running an award sale for fares booked tonight and flown between August 19 and December 17. This one has:

– Transcons from 7,500 miles

– Mexico from 7,500 miles

– Alaska from 17,500 miles

– Hawaii from 7,500 miles

Based on my searches, Delta is quietly matching this fare sale to and from Delta hubs. - You’ve now got another Card Pointers free alternative in addition to

faux-cardpointersamex-load-offer.js. The US Credit Cards 101 Chrome plugin adds a button to the American Express offers dashboard to add an offer to all cards on the same login simultaneously, rather than just to a single card.

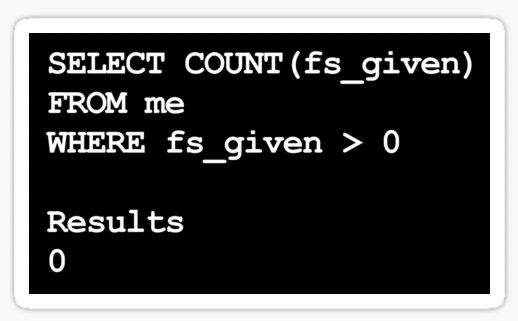

One day, credit card issuers will learn about database atomicity, but we’re not there yet.

Happy Thursday!

The American Express technology team’s unofficial poster.

(Sorry, sometimes database humor can’t be helped)