Introduction

At MEAB, we encourage churners to think about bank bonuses in terms of simple APR: for example, a $300 bonus on $30,000 deposited for 60 days is effectively an APR of roughly 6% (about $300/$30,000 * 365/60 * 100%). When savings accounts already earn 5.5% or above, this bonus almost certainly isn’t worth your time.

The Velocity of Money as an APR

The same rule applies for the velocity of money, even though no one really talks about it. What do I mean? Let’s assume you’ve got a simple rewards debit or credit card that earns a net profit of 0.65% for sending money through a FinTech (yes, this exists in myriad places in the real world). Assuming you can scale this, we’ve got a near perfect APR analogy for the velocity of money:

APR = spread * velocity

In this equation, velocity means bill pay cycles per year, or put more directly:

APR = spread * banking_days / settlement_time

Let’s take a concrete example: Assuming spread = 0.65%, banking days = 252, and settlement time = 3 (avoid kiting), we get:

APR = 0.65% * 252 / 3 = 54.6%

54.6% effective simple APR!

Conclusion

Moving money repeatedly with even a small spread has a huge effective APR, which you should keep in mind when deciding whether to park money in a high yield savings account, work on a bank bonus, or to scale your existing operations. Money in motion for a churner is often better than money at rest.

Happy Wednesday!

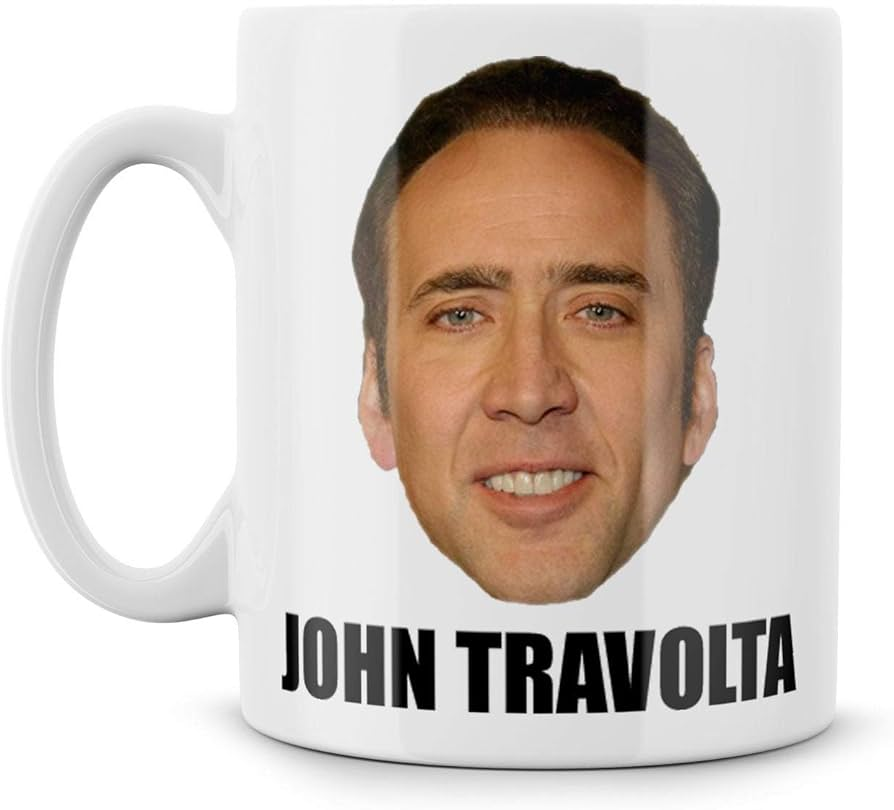

Next time on Wednesday Wisdom: Did you know that John Travolta = Nicolas Cage? This mug proves it.

4 thoughts on “Wednesday Wisdom: The Velocity of Money, Part One”

Comments are closed.