- Do this now: Register for 25,000 bonus Bonvoy points at Marriott Homes and Villas for bookings in February and stays through September 1.

Am I the only one who thinks “bonus Bonvoy” sounds derogatory? - The Chase IHG Premier card has a heightened bonus of 175,000 points after $5,000 spend in three months.

Use P2’s another churner’s referral for maximum win. - Kroger brands have a digital coupon for 4x fuel points on third party gift cards in store, excluding Amazon and flexible gas cards through Tuesday, February 17.

The fuel point and gift card resale market are currently strong for a February, make sure you shop around. - Kroger has a digital coupon for a fee-free variable Visa or Mastercard loaded with $150+ through Tuesday.

These are Pathward / BlackHawk Network gift cards. - The Incomm sites have Valentine’s Day fee-free gift cards:

– TheGiftCardShop 100% off of purchase fees through February 15 with promo code LOVE26

– MasterCardGiftCard 100% off of purchase fees through February 14 with promo code VDAY26

– VanillaGift 100% off of purchase fees through February 14 with promo code VGVDAY26

VanillaGift chose to use the tagline “For the Love of Gifting”, which I hope makes the floosies laugh. - Delta has an award sale for non-basic economy main cabin travel to and from Europe booked today for 26,000-28,000 miles round-trip.

- Spirit has 90% off of base fares booked today with promo code 90PCT for Tuesday, Wednesday, and Saturday travel through March 11.

In case you’re wondering, which I’m sure you weren’t, I think you’ll get a bigger discount than the odds I’d give that Spirit hasn’t ceased operations by March 11. (Thanks to FM) - Breeze Airlines has 26% off of base fares for weekday round-trip travel booked today for flights through September 15 with promo code WEEKDAY.

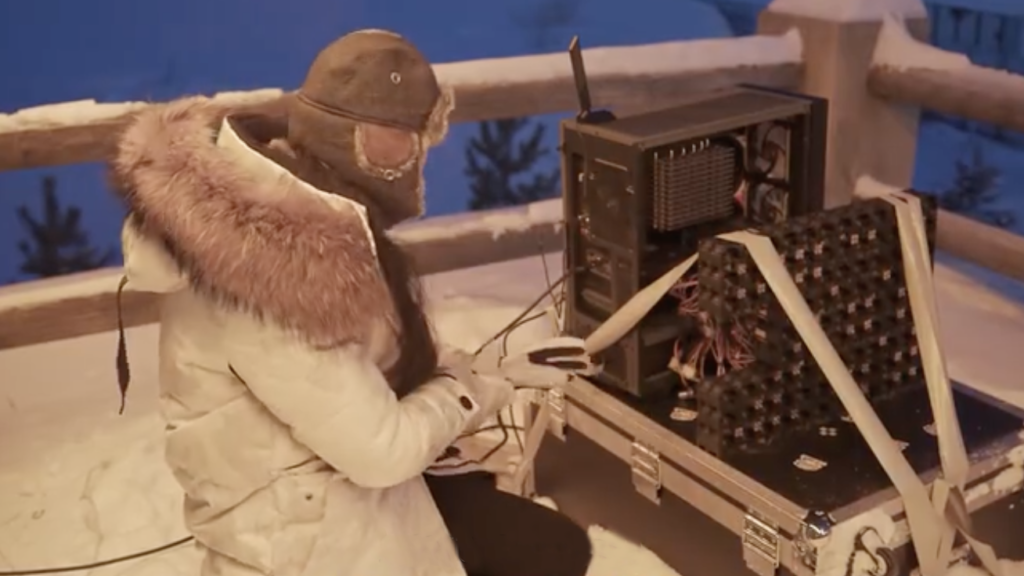

Let’s call out the square for the next round of Breeze Route Bingo: Brownsville (BRO) to Orlando (MCO)! Today only, you get a bonus middle square if you already knew where BRO was – I sure didn’t.

Have a nice Thursday!

BRO airport (probably)