Pretend you’re on a deserted island filled with nothing but (1) cheese and (2) a zookeeper that will transport you off the island, but only transport you if you can name at least seven recurring credits on popular credit cards in sixty seconds or less. Why a zookeeper you ask? I’m unsure, he isn’t taking questions. Don’t get distracted.

Anyway, now that your fate is sealed, let’s zero in on the American Express Platinum and Business Platinum $200 airline incidental credit. Yes, you could use it as intended, but generally turning it directly into airfare or a travel wallet credit is more useful. So, you want to shoot for airfare credit, eh? You’ve got three ways to play it:

- Be the first to try something outside of the intended use

- Wait until the first couple of data points come in from the people who were first, then act quickly

- Get around to credits eventually, after all they’ll prolly still work next month, right?

There’s an obvious best way to play this, at least for a mass-market credit on a mass-market credit card: Wait for someone else to try a cash-out and then go as quickly as you can to copy them. If you don’t wait, you might end up as a bag holder on a failed cash-out. If you wait too long, your favorite loophole may have closed and all you’ll have left is in island full of cheese (Ok, ok, that’s not the end of the world either).

Happy Monday friends!

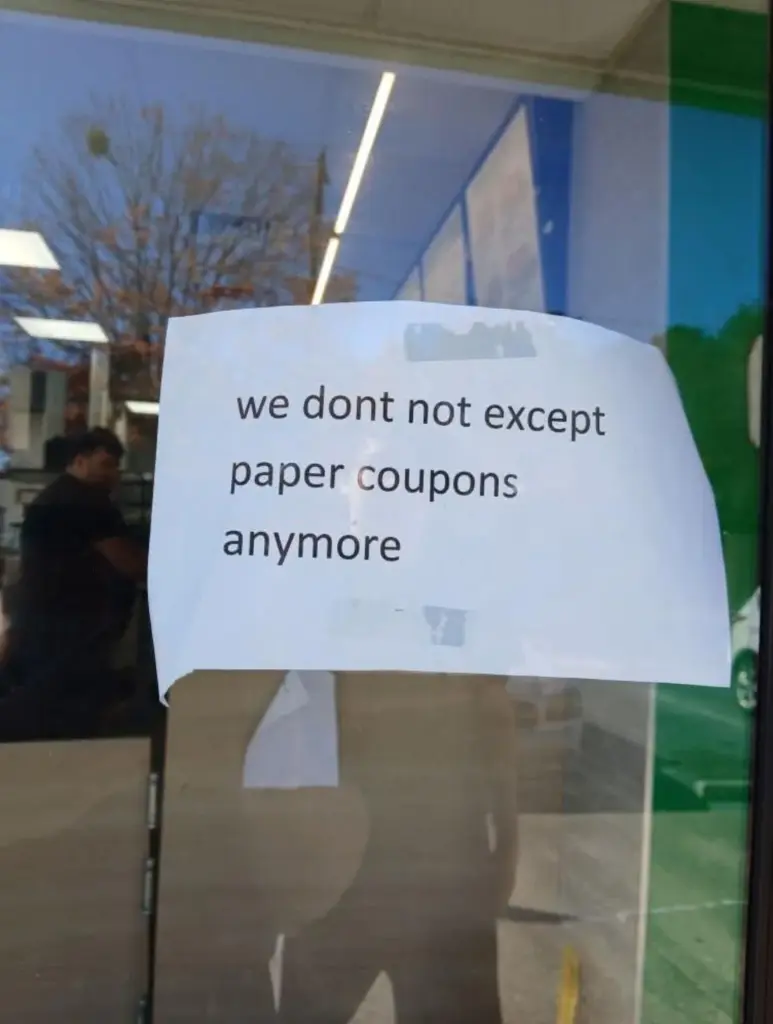

A souvenir from cheese island.