Introduction

How many miles should you hold in a loyalty account before you start liquidating them or choosing to earn something else instead? My hand-wavey answer is: Hold as many as you’ll redeem between now and the next devaluation. Of course, we don’t really know when the next devaluation will happen, but we can look into the last 10 years to try and find patterns on a program specific level.

Why Programs Devalue

Before we do that, let’s remind ourselves why devaluations happen:

- Inflation happens, and mileage earning is tied to prices

- Airline CASM increases over time

- Hotel CPOR increases over time

- Devaluing a currency helps a balance sheet

Devaluations suck, but they’re entirely predictable over time. If we take as a given that programs will devalue, the next logical question is “how often?”

The Frequency

I collected data for frequent flyer program devaluations from the year 2015 until now for the major five US airlines. For this dataset, I only considered redemption devaluations; I excluded elite program changes, the removal of free-stop overs, and similar perks that aren’t directly tied to the mileage redemption rate. Some of these devaluations were only for specific types of redemptions (for example, partner awards to Europe), but that didn’t matter for this study. If redemptions devalued in some way, they were included here.

Now, let’s go airline by airline, sorted by frequency of devaluation:

Delta (10 devaluations): February 2015, August 2016, August 2017, June 2018, March 2019, October 2020, February 2021, April 2022, October 2022, September 2023

United (6 devaluations): October 2016, November 2017, November 2019, April 2020, May 2023, April-May 2024

Southwest (5 devaluations): April 2015, April 2018, April 2021, January 2024, March 2025

Alaska (5 devaluations): March 2016, July 2018, October 2019, March 2023, March 2024

AA (2 devaluations): March 2016, April 2023

Ok, now what’s the expectation value for a devaluation in each program, just taking the number of devaluations divided by the time period (10 years)?

| Airline | Devaluation Time (Expectation Value) | Standard Deviation |

|---|---|---|

| Delta | 1.00 years | 0.42 years |

| United | 1.67 years | 1.05 years |

| Southwest | 2.00 years | 0.88 years |

| Alaska | 2.00 years | 1.11 years |

| AA | 5.00 years | 2.23 years (sqrt(5)) |

What do I do with that?

Alright, how do you make this data actionable? Well let’s go back to my hand-wavey metric for when you should stop holding miles in a particular program: Hold as many as you’ll redeem between now and the next devaluation.

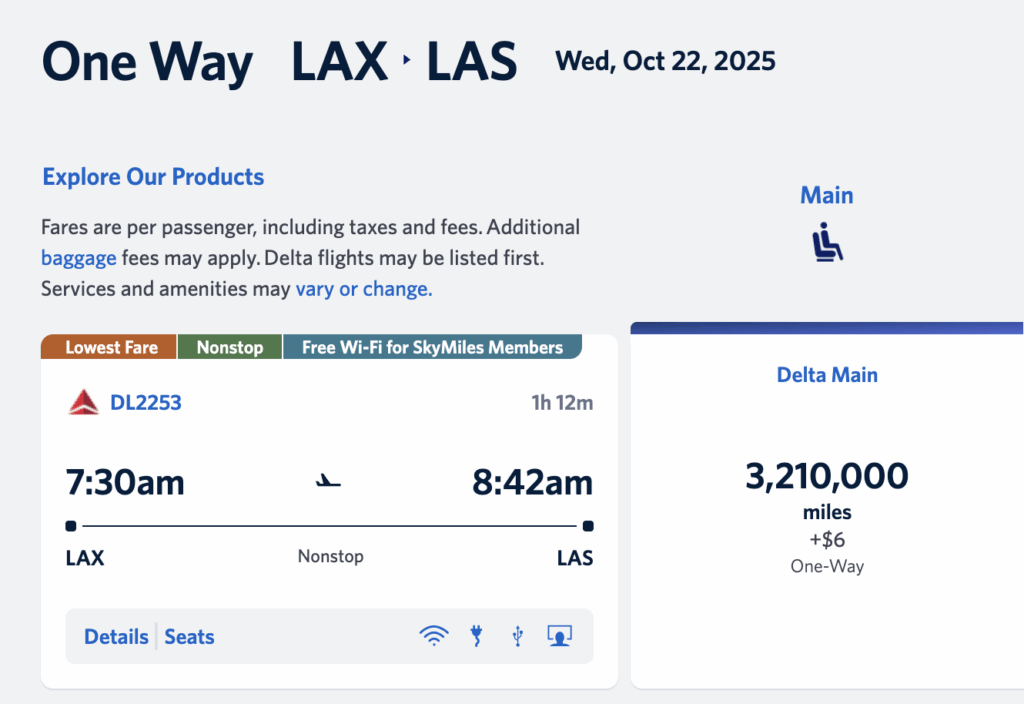

That means that I wouldn’t hold more Delta SkyMiles than I’m likely to redeem in the next 1.00 years, or at least the next 1.00 years after October 2023 (😬 Spoiler alert: It seems likely that we’re going to see another Delta devaluation soon.) It’s also yet another argument about why you should be holding flexible currencies that transfer multiple places and can be cashed out directly.

Good luck out there, and have a nice weekend!

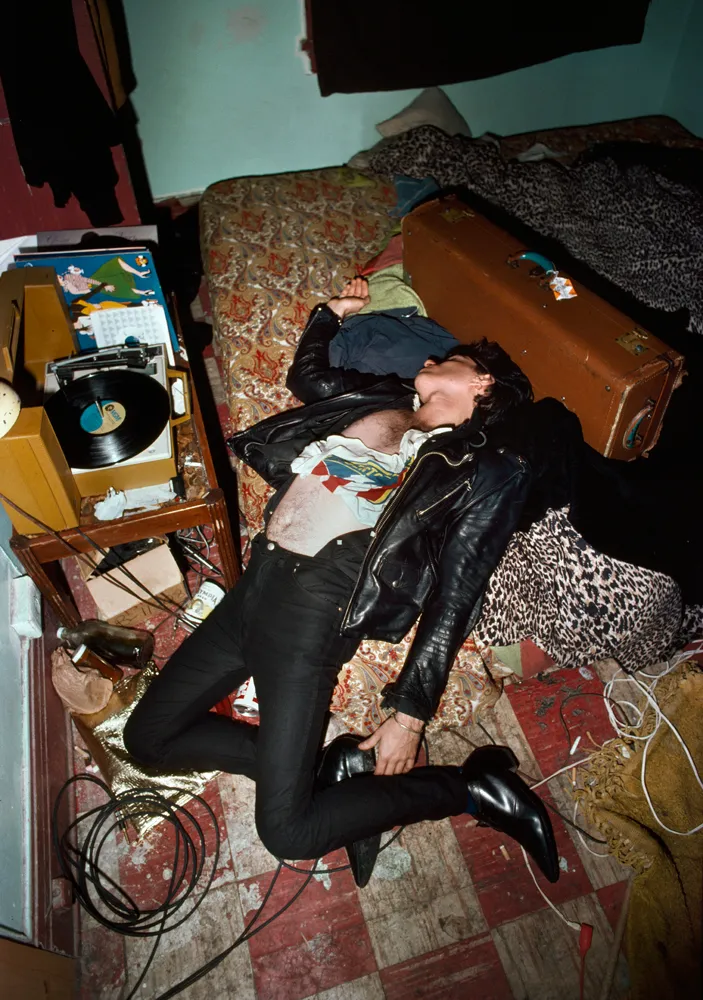

Coming soon to Delta, probably.