Card issuers like American Express and Chase famously have cards with:

- Statement credits that reset every calendar year

- An annual fee that posts on the 12th statement

- The ability to cancel a card and refund the fee for 30 days after it posts

Taken as a whole, these three bullets mean that late November and December are the ideal times to get a credit card with annual credits. For example, the American Express Business Platinum card has:

- $200 airline incidental credit every calendar year

- $200 Dell credit every six months

- $189 Clear credit every calendar year

If you get the card on December 1, 2023, then your 12th statement won’t generate until (at the earliest), December 15, 2024, and thus you can get an annual fee refund through January 14, 2025. That means as long as you hit spend early and cancel the card before January 14th, 2025 you’ll get:

- $600 in airline incidental credits (2023, 2024, and 2025)

- $800 in Dell credits (2H2023, 1H2024, 2H2024, 1H2025)

- $450 in Adobe credits (2023, 2024, and 2025)

- $567 in Clear credits (2023, 2024, and 2025)

(though you should discount those Adobe and Clear credits significantly)

There are a few gotchas to watch for, such as how Bank of America’s annual fee refund after an annual fee posts isn’t guaranteed, or how the Chase Sapphire Reserve’s travel credit is tied to cardmember year, not calendar year. But, you’re enterprising people, right?

Good luck!

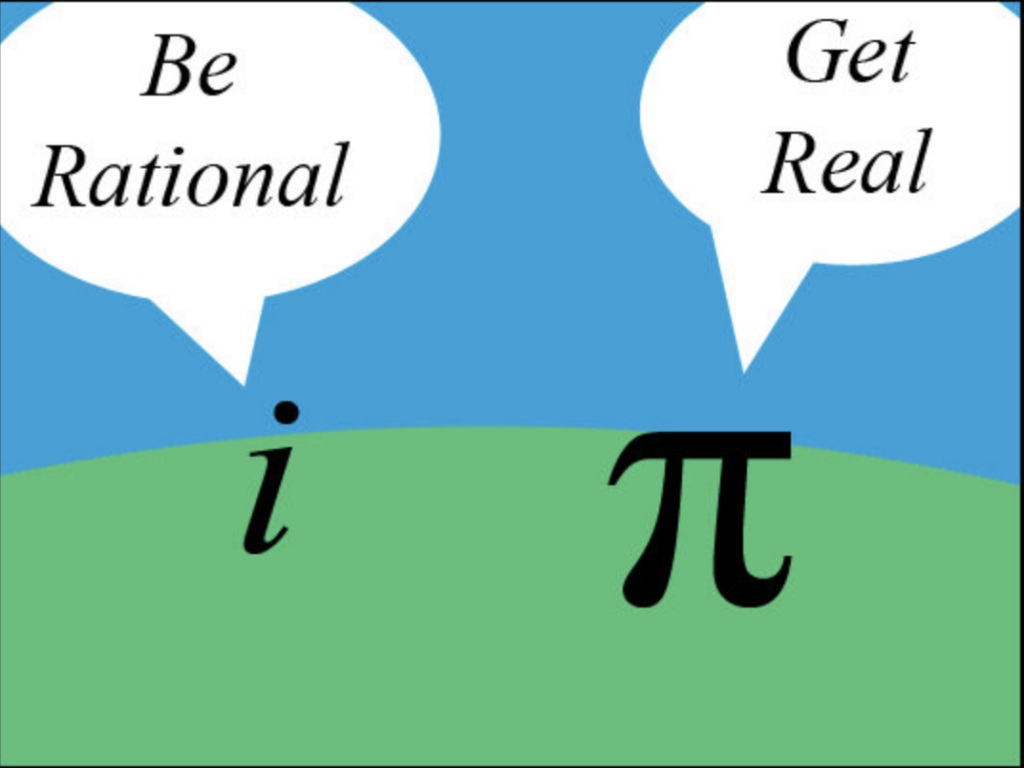

The triple dip visualized as jello. From top to bottom, red (2023), white (2024), and confused (2025).