As I’m sure you’re all quite aware, 2022 is turning into either a pumpkin or into a potato in the next week and a half (depending on your preferred metaphor), and that means you’re nearly out of time for finishing off annual spend thresholds, bonuses, and credits. So, mind the following gaps:

- Spend through any of your remaining American Express, Chase Ritz Carlton, Bank of America, or PenFed Pathfinder airline fee credits, and consult this post for ideas if you’re not sure how to use them. If United TravelBank is your preferred method, do it today because last year TravelBank went offline in the last week of December and it could happen again this year.

- Liquidate American Express credits at Uber Eats or Uber, and remember that your December Uber Cash balance is bigger than other months if you have a Platinum card (or 11).

- Check for any annual fees that posted and call the bank for a retention offer, or just chat online if it’s is American Express. I usually say something like: “I’m thinking of closing this card because of its high annual fee, but before I decide what to do I was wondering if there are any retention offers or spend bonuses.” If you get an offer, don’t forget to add: “Are there any other offers available?” Sometimes there are better offers if you keep asking.

American Express specific note: If you accept a retention offer, plan on keeping that card for 12 months to avoid getting popups that deny credit card bonuses in the future.

- Spend through your $10 monthly wireless credits on each of your Business Platinum cards.

- Spend any $10 American Express Personal Gold dining credits. My go to is the local coffee shop for a coffee and a crepe which jumps just north of $10 on GrubHub. Buying physical gift cards at a ShakeShack or Cheesecake Factory is another option.

- Cancel any cell phone burner accounts that you’re done with (and for which you didn’t use a virtual credit card number that already expired).

- Finish off any Q4 5x bonused spend on Chase Freedom cards, Discover IT cards, US Bank Cash+ cards, Citi Custom Cash cards, or similar, and don’t forget the emu farm option.

- Book any American Express Fine Hotels and Resorts (or The Hotel Collection) stays with your $200 Platinum credit for upcoming travel next year, even if it’s speculative. Historically American Express’s systems lose some of their memory after the calendar turns; it’s not guaranteed but it’s worth a shot at gaming.

- Use your Chase Sapphire Reserve $300 travel credit with a refundable travel booking if needed. Yes, this credit is now tied to cardmember year instead of calendar year, but that doesn’t mean you shouldn’t knock it out now if you haven’t already done so.

- Use any American Express Saks $50 credits, but make sure you activate the benefit first. My preferred method is to stop by a physical Saks store and buy gift cards to resell at approximately 83% of face value, but if that’s not a good option for you, Agile.Travel put together a nice list of options for things to buy last year and it’s largely still relevant.

- Spend or sell any American Express Clear credits, or gift them to a friend.

- Check for any credit card spend bonuses that you may want to hit before the end of the year, like:

– World of Hyatt Visa free night certificate after $15,000 spend

– American Express Hilton Surpass and Honors Business free night certificate after $15,000 spend

– American Express Hilton Aspire and Honors Business second free night certificate after $60,000 spend

– American Express Delta Platinum MQM boosts after $25,000 and $50,000 spend

– American Express Delta Reserve MQM boosts after $30,000, $60,000, $90,000, and $120,000 spend

– British Airways Visa companion ticket after $50,000 spend

– JetBlue Visa Mosaic status after $50,000 spend

– AA status with Loyalty Points

Happy Tuesday!

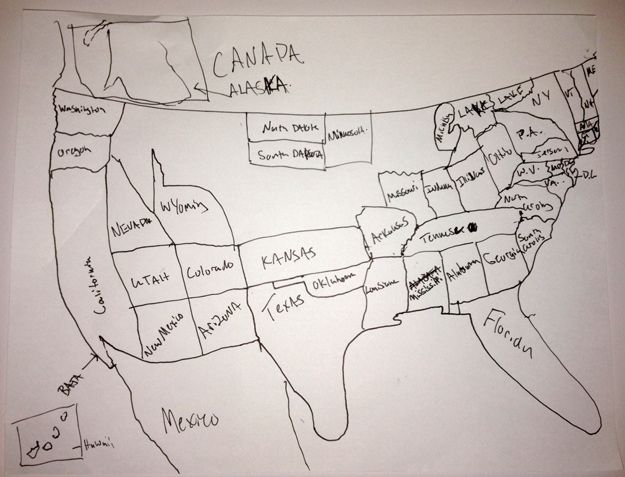

A January 1, 2023 portrait of 2022.