Today’s post is a timely guest post by James, the host of the Churn and Burn podcast. This his his third guest post, see his first and second for further reading. Special thanks to James!

The manufactured spend (MS) world is full of “in-group” and “out-group” code phrases that tend to get repeated within the social circles of our second job hobby. One of my favorites: Social Engineering. Typically, we use this phrase to reference our unwanted contact with the out-groups. “I just had to socially engineer my way through this Chase reinstatement call” is something many of us have said to many a P2. Every manufactured spender has their own unique skill set with strengths and weaknesses. Social Engineering is perhaps one of the most underrated ones, and I excel at it. My personal background is heavily grounded in acting and public speaking. I’m not a numbers guy. In another life, I could have eschewed my churning career for one as a stage actor. It’s part of the reason why I have a podcast that caters only to the worst of the degens, instead of a blog with a cult following.

However, something that’s rarely spoken about is the role of social engineering and its role within the in-group. No one likes to talk about it, at least not openly… but it’s a huge component in this space, so much so that MEAB himself started an entire blog just to open himself up to it.

I know exactly four different “Matts” in the world of MS. Recently, one of them shared a theory with me that redefined the way I view everything we do:

“Everyone feels like they are trying to level up in MS, but there are actually no levels. It’s a circle. Wherever you enter the circle feels like the bottom. Someone on the left side of the circle interacts with the right side of the circle. They both have a new piece of info, their first goal with that info is to use it to level up. Whoever they believe is at a higher level than them now gets that info for “free” because they try and leverage that info.“

We could go back and forth for hours about whether it’s appropriate to “trade” plays or how people should go about determining who they deem worthy to share sensitive info with. I’ve seen countless MS empires rise and fall based purely on what info was or was not shared and who did or did not share it. I’ve been rewarded tremendously just because I shared the right thing with the right person, and have been quite literally excommunicated from certain plays because I refused to share sensitive info with others. But I do think we can all agree on one thing about Matt’s theory: knowing where you are in that circle (and where others are circling) is absolutely critical.

We all want to believe that [insert name here] Points and Miles influencer with 100,000 followers is secretly hiding several high level plays that would shake us to our very core if we knew what they were truly doing behind the scenes. We all want to think that the people who speak at the yearly meetups are all in some back room in between seminars talking about how they’re doing 6 figures of MS per day using some crazy loophole that they’re only sharing with the other whales because they’re part of the in-group, while the other 300 minnows who paid for their tickets are outside watching James Churn and Burn explain (poorly) how to maximize their Hilton Free Night certs. Here’s the rub, though: I can confirm, fairly conclusively, that with a few notable exceptions, the aforementioned picture I drew above detailing some kind of insider points blogger mafia is mostly a fiction. These are not the droids you are looking for, and the real closeted whales are probably sitting in the back of those seminars, chilling on their laptop, doing more MS in an hour than the person on stage will do all month.

So I want everyone to stop and think right now. In all seriousness, ask yourself this question: For every play you’ve discovered with some amount of outside help: did you ask for it, or did it just spontaneously fall into your lap through some variance of “right place, right time” happenstance? More importantly: Can you even remember how you found the play in the first place?

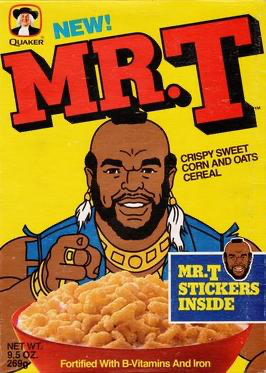

One thing’s for sure. If you heard about it from a publicly hosted Youtube video on a wildly popular influencer’s channel, chances are quite good that you’re somewhere at the bottom of the circle.

– James

It could be worse than the bottom of the circle.