EDITOR’S NOTE: Matt is on vacation until at or around January 1, 2026. Until then we have guest posts, today’s post is brought to today’s post is brought to you by DucksRising, a reflective and reluctant heavy hitter. Special thanks for the post!

Introduction

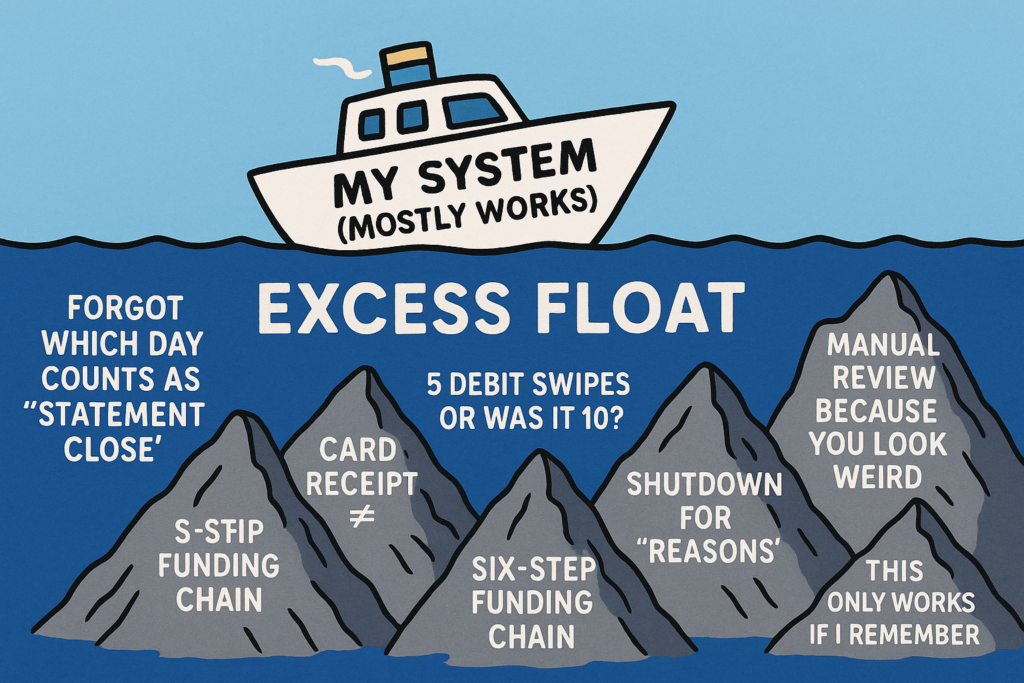

During the pandemic, I was recruited to join a group manufactured spend (MS) play. This play involved hundreds of users and mimicked the operations of a large buying group. Already familiar with the rest of the credit card optimization landscape, I followed the predictable arc of every other user – initial small investments, followed later by larger purchases, eventually climaxing into a scale that seems unrecognizable at this point. Among certain apex predators, the profits from participating in this group were stratospheric. I have no doubt that the anecdotes of a few noteworthy purchases helped normalize the prevailing attitude that one should always be pushing higher, farther, and faster. Much like Karen Hill observed during the wives gathering of Goodfellas – it all seemed so normal when you were surrounded by it. I distinctly remember “don’t be poor” becoming part of the lexicon at some point in time. My own returns exceeded some of the users who participated at the minimum level, and generally provided more than what I would have gotten paying taxes and buying Visa gift cards, but thankfully I never reached the upper echelon, for reasons that will become clear.

During 2023, it became rapidly clear that the bottom was falling out of our joint venture. After a few days, leadership posted a message that they were lawyering up and severing all communications. Whether it’s social anxiety, an attitude of “F*?k The Bank” at all costs, or traditional narcissism, I have noticed for quite some time that every award blogger or noteworthy figure in this hobby seems deeply flawed at best, troubled at worst. Some of these figures are so awful they have spawned parody social media accounts. The culture and leadership of this group was more or less on this level.

Leadership attempted to nominate a replacement, an imbecile (probably seduced by the ideas of collecting the same administrative fees the original leadership had collected) who lasted exactly a day before loud-quitting via group message. Eventually it would turn to 3 people who made a reasonable pitch at righting the ship – they too would fail, although their effort seemed genuine – it is difficult to say how much was ever in their control. Original leadership’s only actual parting gift was organizing the hundreds of users into collections of individuals who had participated at a level similar to their own. Some of these groups were active, most were not, and in the end there ended up being two groups – those who had participated at a large level, and everyone else.

Money Talks, Bulls*#t Walks

Much like the pandemic showed that humanity’s natural instinct towards retreating into tribes is undefeated, these groups formed diametrically opposing viewpoints. The smaller group who demonstrated significant spend always seemed to have more information and always be one step ahead. They also generally looked down upon the larger group, referring to this group as “the masses”, “the poors”, etc. The larger group seemed more diverse, more outspoken, and at times significantly more unstable. Screenshots from each group occasionally made it to the other channel, igniting controversy. Regardless of these dynamics, it was clear after 1-2 months that a significant percentage of initial investments were not returning to anyone; they were lost.

One of the great fallacies of our hobby is optimization – the idea that you should be extracting as much money from the banks as possible at all costs. This is only partially true. You should only be grabbing as much low hanging fruit as possible. Even most award bloggers lose sight of the fact that spending time banging at Rakuten, shopping portals, etc. is generally a net negative. Seeing the entire picture is paramount.

Blitzkrieg

Again, during 2023 the entire picture trying to recoup tens of thousands, or in some cases, hundreds of thousands of dollars, seemed daunting. Some users of the group experienced a profound mental health crisis. Some seemed unbothered. Most landed somewhere in the middle of this. The outside perspective was difficult to deal with – rival buying groups and moderators from varying subreddits openly cheered on the demise of the group and encouraged suicide. Some tribes are… built differently than others. Amidst this chaos, and with the perspective of time, the landscape view showed something different – while American Express was the biggest problem for almost everyone, many had positions spread across anywhere from 2 to 7 banks.

Another factor: financial institutions are filled with incredibly stupid people, and simultaneously do not give their employees an opportunity to help. It rapidly became clear that fighting your own personal lightning war against the banks was the path toward success. Certain departments within a handful of specific financial institutions quickly were overrun and approved the return of credit card purchases en masse before eventually applying speed gates. This would repeat later with Paypal. The days of the PayPal Mafia are long gone, but in a deeply ironic twist, despite being outshone by their hotter sorority sister Venmo while also having outsourced all of their customer service operations abroad, PayPal was the only company to be proactive: running a query, sorting by spend, and apparently calling various whales of the group attempting to figure out why $17 million in payments were being returned. Simply put, many of these institutions rely on lowly-paid customer service grunts to flag and elevate issues, although the exact procedure for larger banks is likely a bit more proprietary and nuanced. The smaller the bank, generally the more generous, and generally speaking after 3-4 months the majority of users had all or the majority of their investment recouped. There were some individuals who were out $10,000-$20,000 here and there, or for whom it took 6-12 months to become whole, but the common denominator in this group was garden variety incompetence. Shutdowns came and went, some were actually defeated by what seems like a handful, and in some cases are still progressing to this day.

El Fin

With the benefit of hindsight, there are too many other lessons learned across too many parts of one’s life to expand on. I learned that the line between playing a small role and medium role in a joint venture can be rapidly crossed with little to no thought outside of the financial rewards. I learned applying large stress tests to a financial institution comes with a considerable responsibility – being able to bullsh*t dynamically, reading T&Cs, leaving your job for an hour at a time perhaps several times a day. I learned that “Flight or Flight” within humans extrapolates congruently with pressure exerted, real or perceived. I learned that, as Gen Z says: when people show you who they are, believe them. Looking down the road – I have no doubt that other plays will emerge (or perhaps already have in other communities), and decisions will again need to be crossed, this time with the benefit of experience. This hobby is unlike most others in so many ways, we’re all mostly wandering without a map at times. As someone much smarter than I once scrawled on a picnic table: There is No Fate But What We Make

– DuckRising

The PayPal mafia: 2025.