Introduction

Holding any loyalty currency in your account for anything beyond what you’ll use in the next 18 months or so is generally a recipe for disaster because:

- Devaluations will happen

- Those accounts might get shut down, forfeiting rewards

- You don’t earn interest on points (well, inflation might mean negative interest)

- There’s significant opportunity cost for the money you could have cashed out

There’s still a great case to be made for holding some points though, specifically for when “life doesn’t care about your booking window” happens, also known as that time you need to travel immediately regardless of how many seats Delta has available in their “Main Basic Extra Minus Enhanced Lite” fare class.

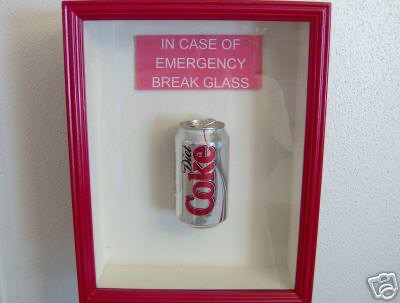

The Emergency Fund

When life hits, you may need to be on a plane or in a hotel room in the next couple of hours, for example:

- You need to travel immediately to care for someone

- A war started nearby

- Your house flooded

- You ran out of flour from a specific mill in France and don’t have time to ship more

At that point, “getting out” is more important than whether or not you have a lie flat bed or whether you’ll get a free sandwich in main cabin extra. It also means that you won’t have time to earn new points to cover your stay, so what you’ve got banked is exactly what you have to work with. In other words, holding a baseline level of points in a few programs can serve as the points equivalent of your cash emergency fund.

In Practice, MEAB Style

I keep a baseline of around 100,000 points in most US airline programs and hotel programs for emergencies. Why 100,000? Well, humans like round numbers, and because that’s generally enough to ensure I can get anywhere in coach and have a night or two in a hotel while I figure out next steps or earn more points as needed. It’s also a level that I’m comfortable losing without any real heartache if my account is shutdown because reasons.

Fin

Hoarding is bad, except when it’s good, naturally. Just keep those hoard levels in check and call them an emergency fund so you can sleep better at night.

Happy Wednesday!

Next time: Building your strategic reserve. (Also eww, Diet Coke)