Credit card rewards are kind of a big deal. Obviously earning 4x at grocery stores, 5x at office supplies, 8x at gas stations, 10x on travel, or 14x hotel spend can be used to leverage lifestyle creep in the form of (choose at least one):

- outsized value

- discount travel

- cash-flow

A non-significant boost also comes from earning on the payment side. Plays vary, but consider some public options like:

- paying your taxes with a credit card or rewards debit card

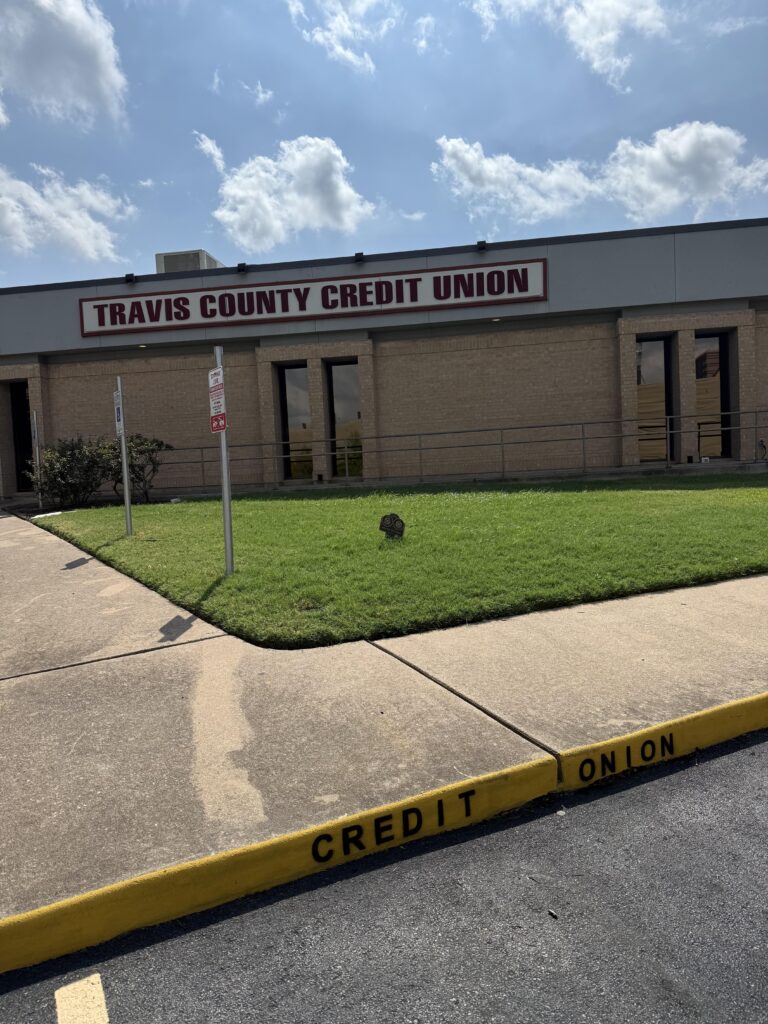

- paying a local credit union HELOC with a credit card or rewards debit card

- paying your mortgage with Plastiq (yes, it still exists)

The biggest unicorns allow payments directly with a credit card, but plenty of demi-unicorns work with a debit card too. A few options:

There are other options too, always be probing.

Three wheel to four wheel upgrade lifestyle creep.