- The American Express Hilton cards have increased sign-up bonuses, though the increased bonuses don’t make up for recent devaluations:

– Honors: 100,000 points after $2,000 spend in six months

– Surpass: 155,000 points after $3,000 spend in six months

– Aspire: 175,000 points after $6,000 spend in six months

– Business: 175,000 points after $8,000 spend in six months

These are available via referrals, use another player or another churner’s referral. Don’t apply head-on, make a churner’s day. - It’s October transfer bonus time:

– American Express 20% to AirFrance/KLM FlyingBlue through October 31

– American Express 30% to Marriott Bonvoy through November 30

– Chase 30% to British Airways, Aer Lingus, and Iberia Avios through October 31

– Chase 80% to IHG through October 31

– United 30% incoming transfer bonus from hotels, registration required, through October 31 (Marriott becomes 60,000:35,000)

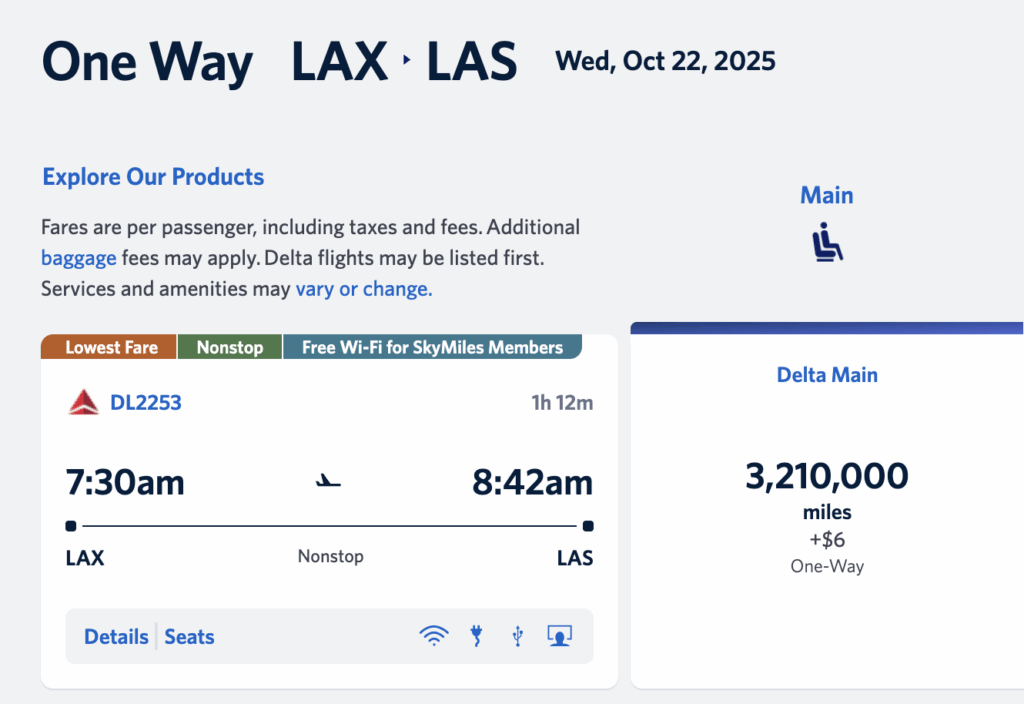

Even with the transfer bonuses IHG is an awful value, and Marriott Bonvoy is of dubious value, though it does offer a roundabout way to convert Membership Rewards to United MileagePlus which after the two bonuses will shake out to 1,000:758 (let’s call this a 6-7). - Royal Jordanian is selling a 12 month long

membership to oneworld airline loungesstatus match to oneworld Sapphire (Gold Sparrow) for $149. You can match with status from most non-oneworld airlines. Oneworld Sapphire gets access to AA and Alaska lounges when flying domestically, including AA Flagship lounges.

The IATA code for Royal Jordanian is RJ (fixed, thanks to Kevin), which believe me will be helpful to know if you’re trying to use this for US domestic lounge access. - Meijer MPerks has a clipable coupon for $10 off of $150+ in Mastercards through Tuesday.

Meijer sells both Sunrise and Pathward / BlackHawk Network gift cards. - The Chase Sapphire Reserve’s Pay Yourself Back categories for Q4 are grocery, gas, department stores, and annual fees for 1.25 cents per point. The “select charities” option at 1.5 cents per point is still around too.

- American Express Offers has lots of new offers:

– Viator $30 statement credit with $300+ through October 31

– Best Western $50 statement credit with $250+ through December 31

– Marriott Brands (various): $200-$300 off of $500-$750+ through December 31

Most things bookable on airbnb experiences are also bookable on Viator, so you may find organic opportunity on that one. - The Barclays Lufthansa Miles&More Mastercard has an all time high tiered sign-up bonus of 50,000+20,000 miles after $3,000 spend in 90 days and $12,000 spend in the first year, respectively.

There is a Swiss First niche where this card can make sense if you’re good at ignoring opportunity cost. Apropos of nothing, where are my FNBO JAL groupies at? (Thanks to pizza42bob)

Happy Thursday!

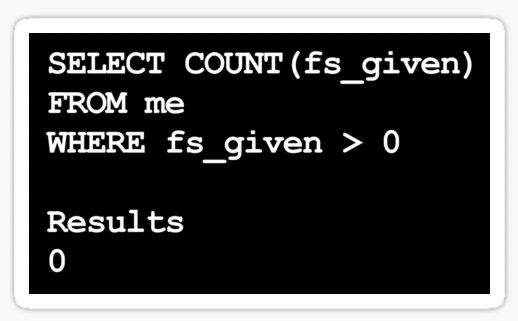

The Membership Rewards United backdoor, as a mug.