Hyatt announced a major change and some minor changes yesterday, scheduled to start in May. The gist:

- Each category will have five price points based on demand, prices will be:

- Category 1: 3,000-9,000 points per night

- Category 2: 6,000-15,000 points per night

- Category 3: 8,000-20,000 points per night

- Category 4: 12,000-25,000 points per night

- Category 5: 15,000-35,000 points per night

- Category 6: 20,000-40,000 points per night

- Category 7: 25,000-55,000 points per night

- Category 8: 35,000-75,000 points per night

- The price of the middle tier for each category is going up between 20% and 38%

- No changes to existing certificates or upgrade instruments

- You’ll be able to share points digitally

- “Early award night availability” for card members and elites

The commentary out there on these changes is wild, including words like “death”, “brutal”, “devastating”, “read it and weep”, and my personal favorite, “elitism“. Look, I agree devaluations suck, and I agree that this one does too. But let’s put a few things in perspective when the rage-o-meter drops a bit:

- In 2014, a Hyatt Place that I used to frequent cost $67 per night, and was 5,000 points

- In 2026, the same Hyatt Place costs $144 per night, and is still 5,000 points (standard)

- Over the same 2014-2026 time-frame, US dollar inflation is +39%

- Hyatt was probably paying about $25 for my award night in 2016, and about $55 in 2026

- The same phenomenon affects high end properties too, probably worse

- Ink card bonuses, which are Hyatt point producers) are about double what they were in 2014

- A six-pack of soda on sale in 2014 cost about $2 and earned me, best case, 3 Hyatt points

- A six-pack of soda on sale in 2026 costs about $4 and earns me, best case, 12 Hyatt points

Ultimately, inflation means that I’m earning more for the same spend, and Hyatt’s paying more for my redemptions. Whether it’s Hyatt or any other program, that means devaluations are coming. There’s only one way to avoid losing much when this happens, and it’s in the site’s title:

Earn and Burn

Miles and points lose value over time, so burn ’em when you get ’em. Or, maybe (definitely) I suffer from elitism.

Happy Thursday!

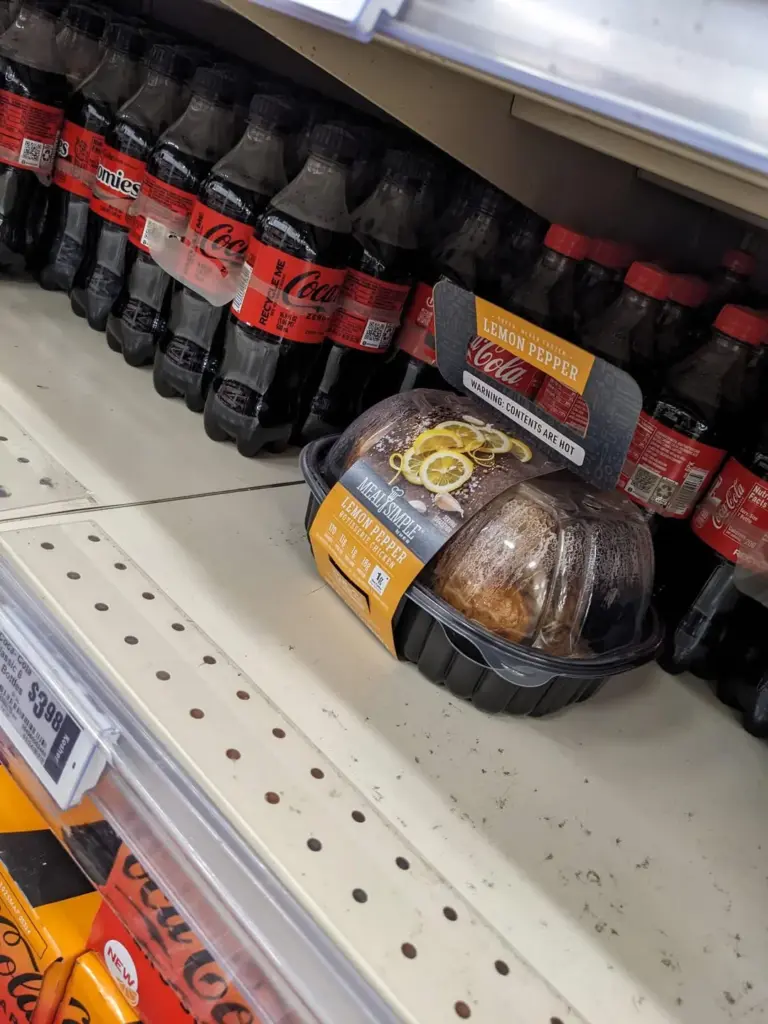

Next up: How many points did an out of place rotisserie chicken earn in history?

Data will include varieties both with and without salmonella, because elitism.