- The American Express Delta cards have heightened sign-up bonuses, all of which are available via referrals too so go that route instead of using a blog link, P2 will thank you:

– Business Gold: 90,000 SkyMiles after $6,000 spend in six months, annual fee waived

– Business Platinum: 100,000 SkyMiles after $8,000 spend in six months

– Business Reserve: 125,000 SkyMiles after $15,000 spend in six months

– Personal Gold: 90,000 SkyMiles after $5,000 spend in six months, annual fee waived

– Personal Platinum: 100,000 SkyMiles after $6,000 spend in six months

– Personal Reserve: 125,000 SkyMiles after $9,000 spend in six months

There’s also a Personal Gold link for 60,000 SkyMiles and a $500 statement credit after $3,000 spend in six months with a waived first year annual fee during the ticket booking workflow, you don’t have to actually buy the ticket to get it. - Four of the Chase United family of cards also has increased sign-up bonuses, and these are available for referrals too, so it’s either your best churning buddy or P2’s time to shine!

– Personal Explorer: 70,000 miles after $3,000 spend in three months, annual fee waived

– Personal Quest: 80,000 miles after $4,000 spend in three months

– Business MileagePlus: 100,000 miles after $5,000 spend in three months

– Business Club: 100,000 miles after $5,000 spend in three months

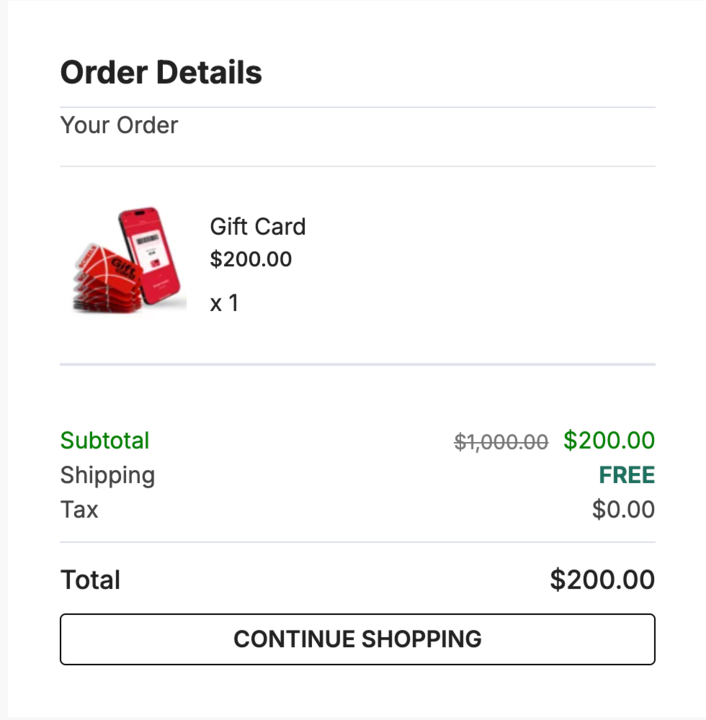

What’s the difference between the last two? A few things, but also an extra $495 for unlimited cheese cubes at any United Club location. I hope you like cheese! - Kroger stores have a digital coupon for 4x fuel points on third party gift cards excluding fuel points cards and Amazon, and on fixed value Visas and Mastercards between Friday and Sunday.

- The Rove Miles Shopping Portal that also has a travel booking engine has several promotions including: 4x on Visas and Mastercards at GiftCards.com, 10x at Viator, and 2x when purchasing Alaska Atmos or AirCanada Aeroplan miles. Increased bonuses run through Sunday.

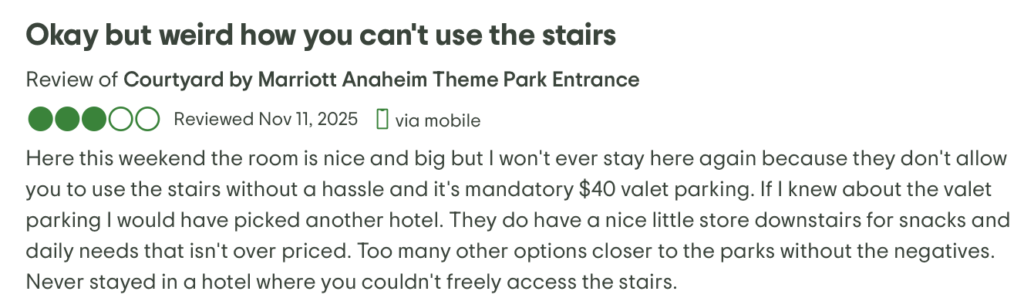

Obviously you should sign up for Rove with either P2 or a churner buddy’s referral. - Stop & Shop, Giant, and Martins have 10x points on Home Depot cards through Thursday, and Giant Food earns 6x during the same period. You’re limited to $2,000 or $1,500 per loyalty account depending on the brand.

- If you want to go all in on Accor ALL, there’s an interesting Accor ALL Signature+ subscription now available world-wide. The important parts:

– Pay 1,149 Euros for a one year subscription

– Earn 1,500 Euros worth of Accor ALL points (75,000 annually / 6,250 monthly)

– Earn 12,000 status points (1,000 monthly)

Gold status requires 7,000 points and Platinum requires 14,000, so earning Platinum becomes almost trivial. Effectively, if you were going to spend 2,000 Euros on Accor hotels in 2026 you’ll come out ahead by about 350 Euros and have Platinum status when you’re done. (Thanks to LL)

Have a nice weekend friends!

Gearing up for Player 2 referral shenanigans.

(Thanks to smirley)