- The Wells Fargo Autograph Journey card, the pop-tart costume version of a credit card, has a heightened, in-branch only offer For Wells Fargo Premier clients of 100,000 points after $4,000 spend in ninety days. The card earns 5x transferrable points at hotels and “hotels”.

Wells Fargo Premier technically requires $250,000 held at Wells Fargo in either a bank or a brokerage account, but paying $35 a month (obviously for only one month before you downgrade) gets you the status too. - The American Express Business Platinum has a new link for employee cards with a bonus of 15,000 Membership Rewards after $4,000 spend in six months, up to five per primary account.

The fozzie wocka wocka is alive and well too. - Office Depot / OfficeMax stores have $15 off of $300+ in Visa gift cards through Saturday. Last week’s Mastercard offer was spotty, working only on some days and only in some stores, so I’d exercise caution with this week’s offer. For best results:

– Buy in even multiples of $300

– Try for back-to-back transactions

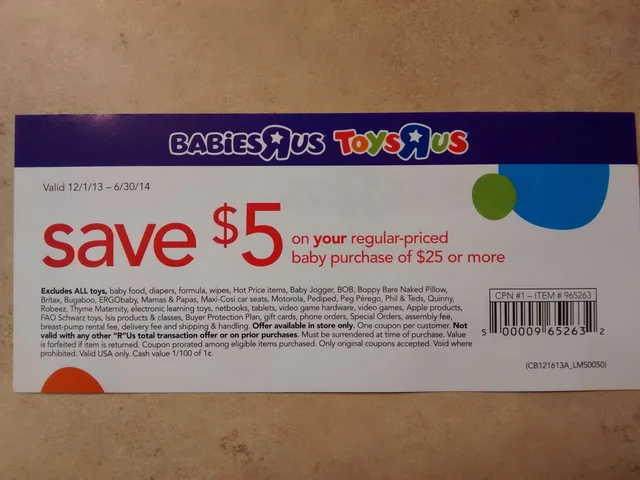

These are Pathward / BlackHawk Network gift cards. - Publix stores have a digital coupon for $10 off of $25 worth of groceries with a $100 Visa gift card through Saturday. Is the juice worth the squeeze on this one? I guess depends on the type of juice.

These are Pathward / BlackHawk Network gift cards.

Happy Monday!

The Wells Fargo Autograph Journey mascot costume, new for Halloween 2025.