- Citi ThankYou Points added AA as a 1:1 transfer partner for the Citi Prestige, Strata, and Strata Elite cards.

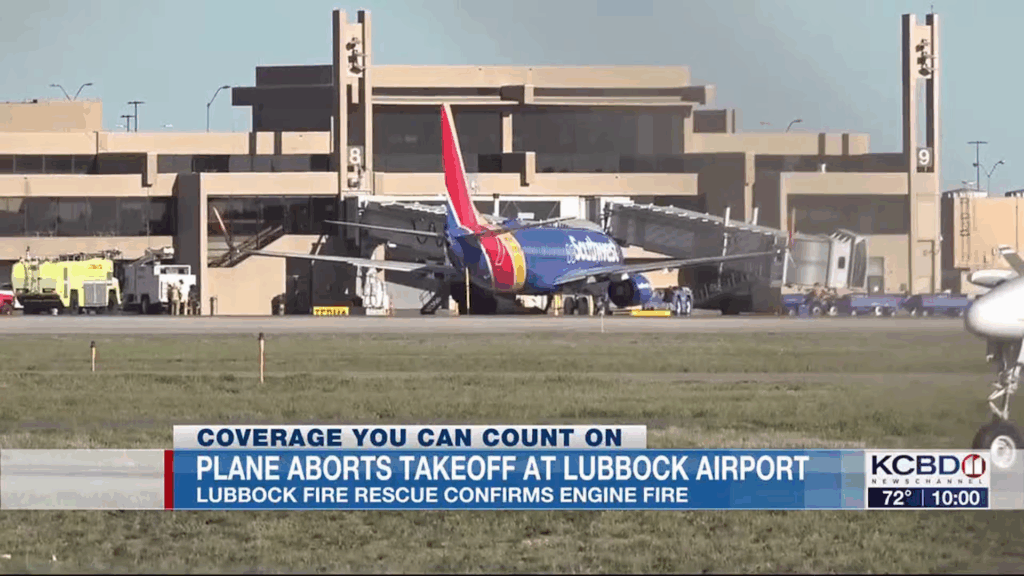

Don’t worry, I checked so you don’t have to. AA Does fly to Preston Smith International Airport. - The Citi Strata Elite card launched over the weekend with a 100,000 ThankYou Point bonus in branch or an 80,000 ThankYou Point sign-up bonus online after $4,000 spend in three months and a $595 annual fee. The card’s highlights:

– 6x on restaurants on Friday and Saturday nights (Eastern Time)

– 3x on restaurants the rest of the time

– 1.5x elsewhere

– $300 annual hotel credit through Citi Travel

– Four AA Admirals Club day passes annually

There are spend bigger bonuses for booking through the often price-inflated Citi Travel portal, and other, lamer coupons and duplicative features too. Personally, I’d just stick with the $95 annual-fee Strata Premier with better bonus categories and (often) an 80,000 point sign-up bonus. - Existing US Bank Smartly card holders transition to the new Smartly earning scheme on September 15, which only offers boosted cash-back on up to $10,000 spend a month, and excludes categories like education, business, and third party bill payment services from earning.

This was a smartly move for US Bank and a lamely move for the rest of us. (Sorry, the fruit was just too low hanging, I couldn’t help myself.) - Bilt’s Rent Day promotion for August 1 is a 20%-100% transfer bonus to Avianca LifeMiles depending on your status. Why mention it now? You’ve still got today and maybe tomorrow to earn more Bilt points.

Happy Monday!

The last fire at Preston Smith was Southwest, not AA. So probabilistically speaking …