- Kroger is selling Marianos, QFC, and Carrs brandnames (and stores) to C&S, the parent company of Piggly Wiggly subject to regulatory approval, and they’re also selling rights to Albertsons branded stores in California, Arizona, Colorado, and Wyoming. This is a double edged sword, but all things being equal as a manufactured spender, I’d rather have:

– A Kroger instead of Piggly Wiggly

– A Piggly Wiggly instead of an Albertsons, at least in recent history

Markets like California and Arizona with both Safeway stores and Albertsons stores will probably get the best of all worlds. - Some airline shopping portals have a sweepstakes running for 25,000 – 100,000 bonus miles, and all that’s required is logging in and clicking a button to enter:

– Alaska MileagePlan shopping

– AA AAdvantage eShopping

– United MileagePlus shopping

Last round there were two separate winners in the MEAB community, and if someone’s going to win it might as well be one of you who probably won’t redeem 73,500 miles for a one-way to Lubbock a United Express First seat in a CRJ-700. - First class tickets on China Eastern are now bookable with AirFrance / KLM FlyingBlue in addition to the normally available business class award tickets. To find them, you’ll need to choose La Premier class on the award search tool.

- The Bank of America Alaska Airlines personal card has a heightened sign-up bonus for 70,000 MileagePlan miles after $3,000 spend in 90 days. The annual fee is $95 and isn’t waived the first year. As with any Bank of America card, if you’re going to go for this offer probably grab some other cards at the same time.

If you’re an value maximizer absolutist, you may want to wait a few weeks to see if an in-flight offer surfaces for 72,000 miles. I’d give that offer a 50% chance of surfacing; just keep in mind that my crystal ball broke in “The Great Christmas tree debacle of 2018”. - The no annual-fee Chase Ink Unlimited and Ink Cash cards’ 90,000 Ultimate Rewards sign-up bonus is back:

– Ink Unlimited

– Ink Cash

Referrals still pay 40,000 Ultimate Rewards to the referrer and have a sign-up bonus of 75,000 Ultimate Rewards, so if you’re running in two-player mode you’ll probably do better to refer P1 to P2. I’d also wait a week or two before doing so because it’s possible, perhaps even likely, that the referral bonus will also jump to 90,000 Ultimate Rewards (however, see prior crystal ball reference).

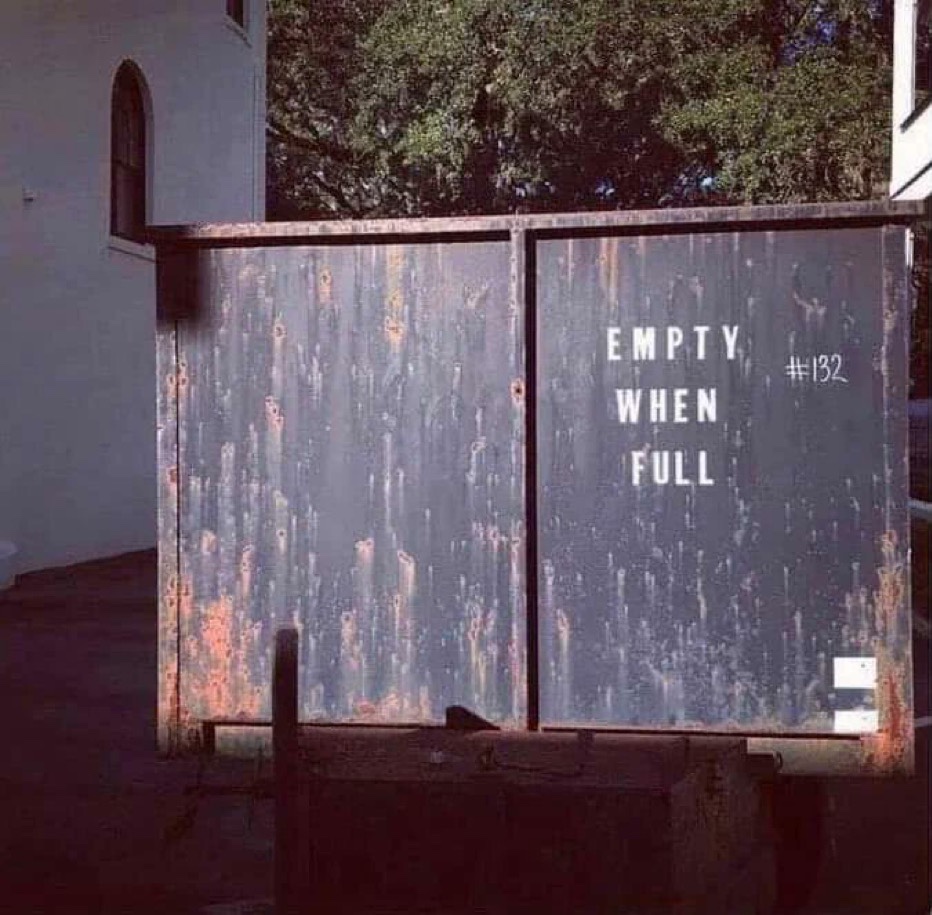

The Great Christmas tree debacle of 2018 shatters the near perfect MEAB crystal ball, or something.