- Meijer MPerks has a digital coupon for $10 off $150+ in Visa gift cards through Saturday, and it appears to be the type of coupon that you can re-clip after use. With the right liquidation path this could easily be worth a trip to Meijerland, but don’t mistake that for Michigan.

Meijer sells both Sunrise and Pathward / BlackHawk Network gift cards. - Synchrony quietly launched the Walmart OnePay CashRewards Mastercard. The vitals:

– $0 annual fee

– $35 sign-up bonus after $75+ spend in 30 days

– 5% for Walmart+ members or 3% back at Walmart otherwise

– 1.5% cash back elsewhere

This card is compelling for scaling buyer’s group activities, at least to the extent that Walmart lets you get away with it and the credit line allows, and also to the extent that Synchrony lets you cycle (they don’t). - Office Depot / OfficeMax stores have $15 off of $300+ in Mastercard gift cards through Saturday. For best results:

– Buy in even multiples of $300

– Try for multiple transactions back-to-back– Look for the lower fee “Everywhere” cards, which despite the name, don’t work everywhere– Cry about Dosh being gone

These are Pathward / BlackHawk Network cards. - Alaska

MileagePlanAtmos has free points for residents that live within 75 miles of several cities:

– San Diego [SDFC registration] [Wave FC registration]

– Los Angeles

– Portland

– Seattle

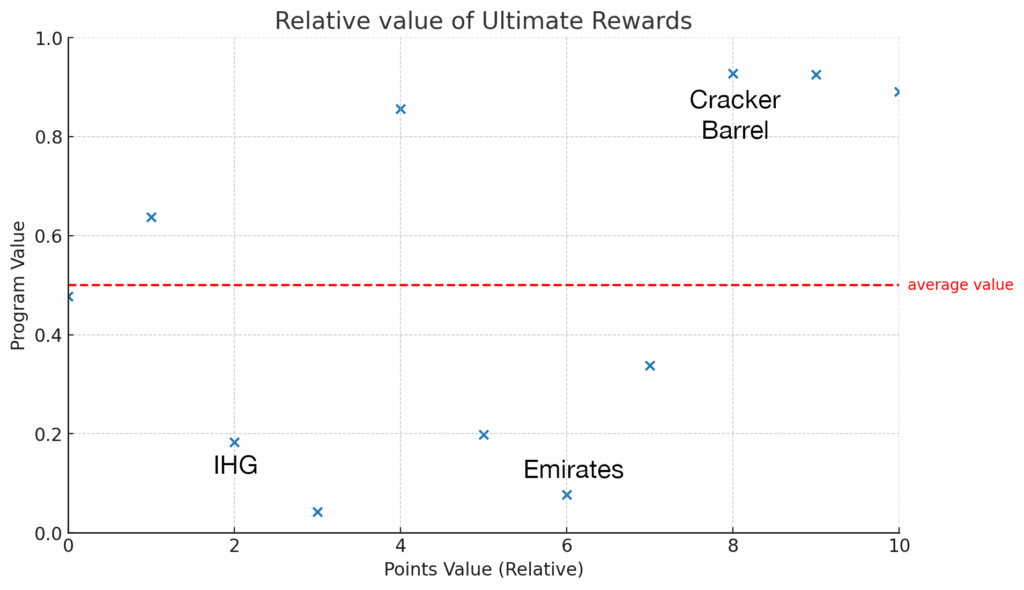

You earn 100 miles per goal scored by your local soccer team for the season, and San Diegans have chances with two teams, probably because one of those teams sucks? Idk, I just work here. - Some Capital One cards have a heightened card-linked offer for 60,000 miles with a $299 purchase at the Motley Fool, effectively buying points at 0.5 cents each.

Just: (1) set a reminder in your phone to cancel the automatic renewal of the subscription after the bonus pays out, and (2) be ready for the frustration of figuring out how to take address off of their email spam list. It sounds easy, but it’s really not. (Thanks to DDG)

Happy Monday!

Motley Fool email preferences page.