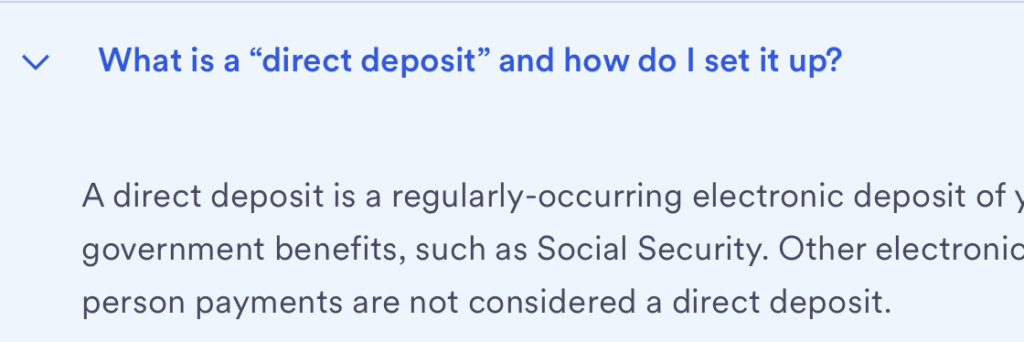

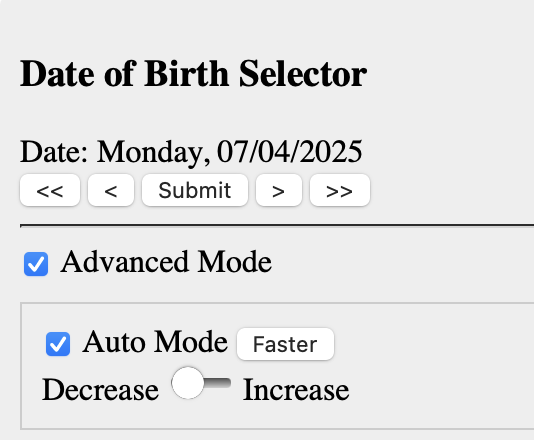

- US Bank has a $1,200 business checking bonus for accounts opened through January 14, 2026 with promo code Q4AFL25. To get the bonus, you need to:

– Deposit $25,000 within 30 days (ideally on day 29 probably)

– Hold at least a $25,000 balance for the next 60 days

– Have five transactions, like $1 ACHs or something

If you hold the money in the account for exactly 60 days, you’re earning an effective APR of about 28.8%, which isn’t bad in this economy. These accounts are scalable with a bit of creativity, and churnable on a per-business basis 12 months after closing. - Marriott Bonvoy has a 15% transfer bonus to AirCanada Aeroplan through October 31. With the bonus, 60,000 Bonvoy points convert to 28,000 Aeroplan miles.

- American Express has a new targeting code for upgrades to Business Platinum cards with 120,000 bonus Membership Rewards after $10,000 spend in three months. Upgrades are available from Business Greens and Business Golds.

With last week’s link, you’ve got least two muppet games to play. - American Express offers has an offer for a $225 statement credit with $1,500+ at Icelandair through December 31 for US originating flights booked in US dollars (sorry, it’s not always that easy).

- AirFrance / KLM’s FlyingBlue program has discounted business class award tickets to Europe from Washington Dulles for 45,000 miles each way between November and February.

Using calendar view by not choosing a start date and trying various major European cities is a good way to find availability. (Thanks to LL) - Rakuten will apparently be partnering with Bilt to allow you to earn Bilt points instead of cash back or Membership Rewards, though the mention was pulled from the site late last night.

Hopefully the ratio of Rakuten points to Bilt Rewards will be 1:1, but given Richard Kerr’s involvement I wouldn’t call that a foregone conclusion. Go ahead Richard, prove me wrong. - Tickets booked through Southwest’s vacation site, the annoyingly named Getaways by Southwest, still get two free checked bags. This doesn’t help you with points bookings though. (Thanks to FM)

Happy Tuesday!

Designing bathroom doors isn’t always easy either.