New card launches don’t usually happen in November or December, but this time’s different for funzies.

- The Sunrise Bank United MileagePlus Visa debit card and bank account launched yesterday. The vitals:

– 10,000 MileagePlus miles after $500+ in four months

– 0.5x earning

– $4 monthly fee, waived with $2,000 on deposit

– Annual mileage earning of up to 70,000 with money held in the account (terrible value)

If you think this card isn’t at all interesting, maybe (1) you’re right, or maybe (2) you’re not seeing something. - The Citi ThankYou Mastercard, the card that’s Citi’s replacing the Shop Your Way Mastercard for existing card holders, has an official bonus category lineup:

– 5x at gas, up to $10,000 annually

– 3x at restaurant and grocery, up to $10,000 annually

– 2x at drug stores and department stores, up to $10,000 annually

– 1x elsewhere

The card gives 100,000 ThankYou Points annually if you maximize each of these categories, and it retains some of the favorite quirks of the old Shop Your Way card too. Taken all together, this card is aiming squarely toward Unsung Hero status, or at least twirling toward it. - The Citi ThankYou Mastercard, still the Shop Your Way replacement, has new targeted spend bonuses, each of which is good monthly for November, December, and January:

– 15% back on up to $175 monthly on $1,000 spend at eligible retail

– 10% back up to $100 monthly on $800+ spend at eligible retail

– 10% back up to $80 monthly on $750+ spend at eligible retail

Eligible retail includes online and in-store purchases at most retail stores other than home improvement, wholesale clubs, and grocery stores. (Thanks to George, Andy N, and JacobS) - US Bank launched a suite of co-branded Edward Jones Investment credit cards. One of the three is interesting. Its vitals:

– 3% on top three categories including unique categories like medical, hospitals, and car dealerships

– Uncapped rewards

– $0 annual fee

They’ve specifically excluded US Mint, Amazon, Walmart, Target, and “other discount stores/supercenters”. - The Capital One T-Mobile Visa credit card launched. The vitals:

– 5% on in-stock phones, devices, and accessories at T-Mobile

– 2% elsewhere

– $0 annual fee, no foreign transaction fees

This card is the only credit card that qualifies for $5 off per line per month, which is typically only available with ACH payments.

There’s some non-credit card news too:

- Choice Hotels now allows points

sellingpooling. (Thanks to CericRushmore) - Alaska has two award fare sales running, one for travel booked by November 6 and flown between December 2 and March 11, 2026:

– Short haul from 4,000 points

– Hawaii from 7,500 points

– Transcons from 7,500 points

And another for economy international flights booked by November 11 and flown by March 30, 2026:

– South Asia from 25,000 points

– Australia and New Zealand from 35,000 points

The latter sale includes partner metal bookings too. - American Airlines has a “spring deals”fare sale for economy travel booked by November 16 and flown between January 12, 2026 and February 28, 2026. Business class bookings aren’t included in this one.

Have a nice Wednesday friends!

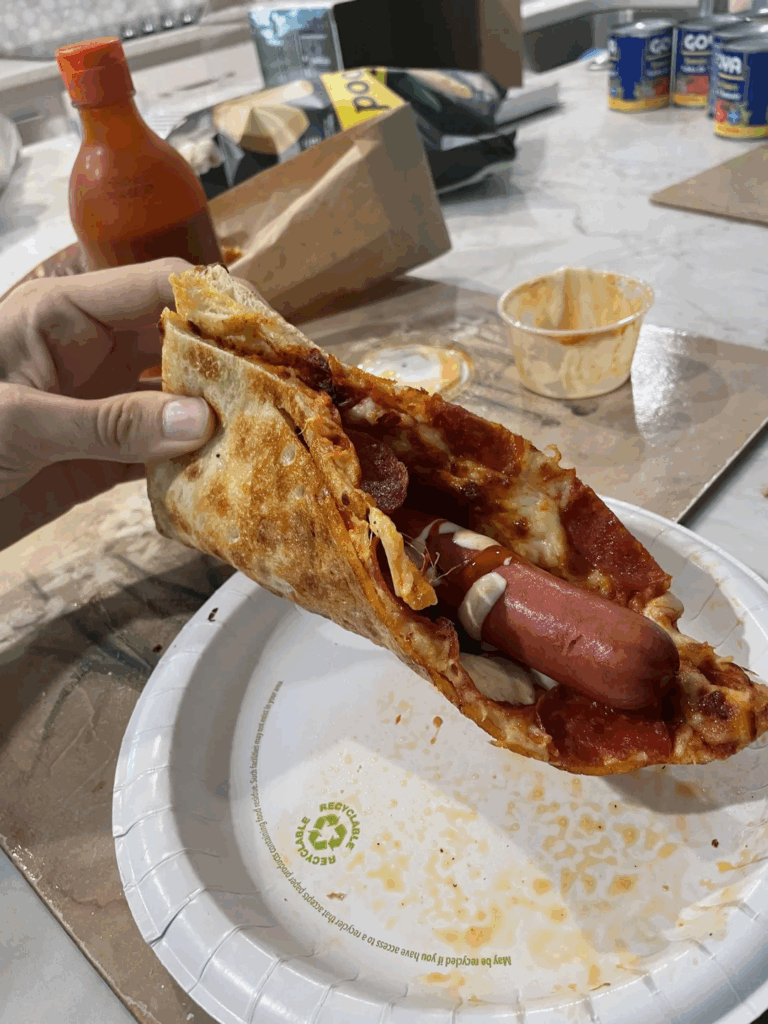

Rejected Edward Jones Investment co-brand design.