- Do this now: Register for AA’s widely targeted promotion for 500 Loyalty Points for each AA flight in March, up to 5,000 bonus points total. Flights need to be booked (or rebooked) after registration to be eligible. (Thanks to VFTW)

- Capital One has a widely targeted offer for 5,000 bonus miles with a 1,000+ mile transfer to JetBlue TrueBlue. The transfer ratio is awful other than the bonus, so your best bet is to transfer 1,000 miles exactly and earn 5,600 TrueBlue miles. On the plus (?) side, 5,600 miles is enough for some short-haul basic economy tickets.

- The American Express Hilton cards have an increased sign-up bonus:

– Honors: 70,000 points and a free night certificate after $2,000 spend in six months

– Surpass: 130,000 points and a free night certificate after $3,000 spend in six months

– Aspire: 175,000 points after $6,000 spend in six months

In case you’re in pop-up jail on those and don’t know how to get out, you can find smaller bonuses that are mostly popup immune for the same cards here. - Staples.com now sells virtual Visa gift cards with gargantuan fees, topping out at $9.95 for a $300 virtual Visa. I guess maybe you can make this make sense if you’re good at alt portals.

These are Pathward gift cards. (Thanks to DoC) - The Chase United Quest’s $125 annual United credits are changing to TravelBank credits in March, which makes one of my least favorite cards slightly more attractive.

- Breeze Airways 45% off of base fares with promo code ESCAPE for travel from March 5 through September 9, and it must be booked by tomorrow.

Happy Thursday friends!

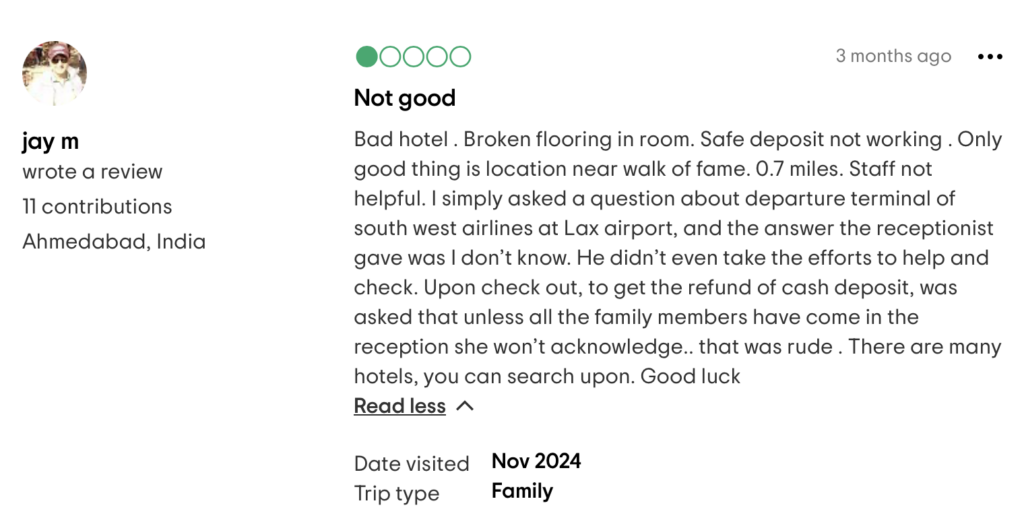

JetBlue basic economy still includes a circa 2012 screen with at least one burnt out color channel and complimentary screen covering.