There are more articles about how to optimize your daily organic spend with the right credit card portfolios then there are people on the planet (citation needed). I think you should ignore all of them. Why? Since you’re here, I’m going to assume you fall into one of two buckets, each with its own reason.

Bucket 1: The Players

As a churning player, you’ve got at least an intermediate understanding of manufactured spend and its execution. You probably know how to spend many thousands of dollars a week, a day, an hour, or maybe even more frequently, and those thousands of dollars mean at least many thousands of points earned in the same time frame.

On the other hand, your regular spend just doesn’t matter much in comparison. Even if you had a magical 10x card, your $15 lunch would earn you 150 points, which isn’t worth thinking about unless it’s purely for entertainment value. Those 150 points probably represent much less than a tenth of a percent of your earning, so don’t stress it. Any card will do.

Bucket 2: The Dreamers

If you’re not yet a churning player, you’re probably dreaming of becoming one (again, otherwise I don’t think you’d be reading this). If so, I’m sure it’s tempting to analyze which of the major bank cards are best for your lunch dining spend. Maybe it’s the American Express Personal Gold that earns 4x on dining, the Citi Strata Premier that earns 3x, the Chase Sapphire Preferred that earns 3x, or the Wells Fargo Autograph Journey that earns 3x? Well, maybe it’s one of those, but:

- they have different annual fees

- they have different transfer partners

- they have different cash-out values

- they have different ancillary benefits

So, which is best given that they’re all different? Maybe you need to build a spreadsheet, list your common expenses, the current point valuations from BigBankBlogger™, the coupon credits each card offers, the sign-up bonuses, when you can cancel the cards and still get an annual-fee refund, whether the card makes sense next to your quarterly 5x earning card capped at $1,500, and a dozen other factors. That’ll be a cool spreadsheet! But, you’ll sink hours into that sheet, it’ll go stale in months, and you’ll find that you’re still a dreamer.

So instead of optimizing your small organic spend, consider spending your would-be spreadsheet time figuring out how to move from dreamer to player. I guarantee you’ll make more points by doing so than the incremental bump you’ll get from an extra 2x when you go out to lunch.

The Big Picture

Optimizing your organic spend is almost certainly a poor investment on your time, unless it’s done purely for entertainment purposes, or because it makes people like MEAB annoyed, or maybe both.

Happy Thursday!

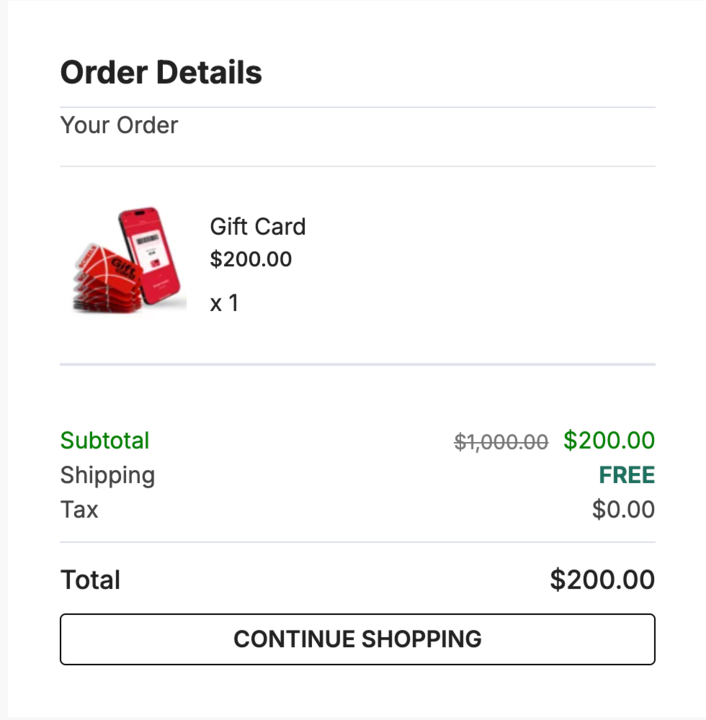

From the page where I got the statistic about the number of point optimization articles on the internet.