- New travel related credit card offers are out:

– American Express: Delta Air Lines $200 off of $1,000+ by April 30

– Chase: Marriott TownPlace Suites 15% back up to $57 by March 12

Chase is usually easier to deal with than American Express when it comes to most things, but also this. - The Barclays JetBlue Plus Mastercard has a better offer of 75,000 TrueBlue points after $1,000 spend in 90 days that surfaced after Monday’s news. This one comes from an in-flight mailer and requires a promotional code. Most any six digit number will work including 000000.

- Bilt is rejecting some mortgage payments from a major mortgage servicer, and I’m guessing that servicer isn’t the only one not working well. It might make sense to wait a month or two for everything to settle before you put your mortgage or

(Sorry guys, I’ve been doing my best to not write about the nearly daily Bilt snafu for a couple of weeks because we all just know that it’s a clusterhug at this point, but this one affects people where they live.)

Have a nice Thursday!

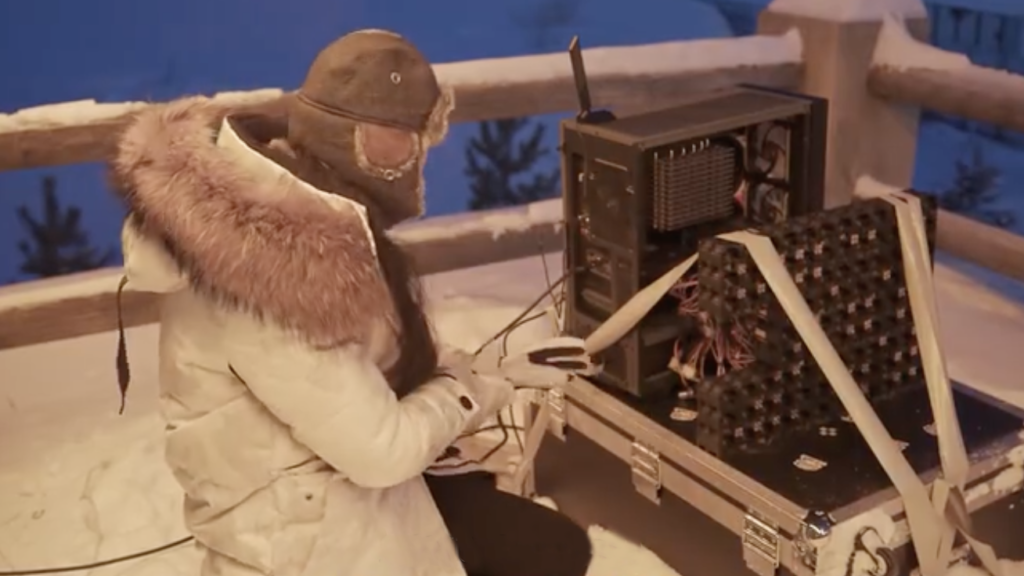

A preview of Bilt’s latest offerings, Homes by Bilt, shows they put the same care into cutting corners in everything they do.