A thought to start your Tuesday: Sometimes this hobby is slow, but based on my experience it’s definitely not slow right now. If it feels slow to you, use the time to get out there and start probing. Keep building your network too; fellow churners and manufactured spenders probably have a few tools that you haven’t used yet. Anyhooldes:

- The Point debit card refunded annual fees on a pro-rated basis and announced the existing version of the card would be shutdown on September 23. They also announced that existing members will get a free year of PointCard Titan when it launches later this year. A few action items:

– If you have a Point card, cash-out your balance sooner rather than later

– If you don’t have a Point card, I’d try and get one now in case the free year of Titan is worthwhile [Update: Point seems to have pulled the application link]I earned over $10,000 in cash back with the Point card, most in the first half of 2021 after launch. I also got quite a bit of no-fee manufactured spend in the first half of 2021. Based on those two experiences I’m hopeful that the new Titan card will present a few nice opportunities. (Thanks to Nathan via MEAB slack)

- Alaska and AA’s shopping portals have a spend bonus like last week’s Southwest and United portal bonuses:

– Alaska: 1,200 bonus miles after $600 in spend

– AA: 2,000 bonus miles after $600 in spendA manufactured spending hall of fame payment processor is still running some giftcards.com cards in a favorable way.

- Clear is running a $75 Uber credit promotion for new accounts. If you still have an unused American Express Platinum $189 Clear credit or two, sign up for an account with new information to cash-out that credit. So far, none of the Clear promotions like this have needed a complete enrollment at the airport in order to pay out.

Remember, if you don’t cash-out every one of those Clear credits, the terrorists win. (Thanks to FM)

- According to DoC, more people have been targeted for an American Express Business Gold or Green upgrade offer to the Business Platinum for 140,000 Membership Rewards after spending $10,000 in three months. To see if you’re targeted, login to AmEx, set a Business Green or Gold card as your default card, then click ‘Request an Upgrade’ at this link.

- In a move that should surprise absolutely no one, starting tomorrow and running through Tuesday, August 9th, Kroger is having another 4x fuel points promotion on third party gift cards.

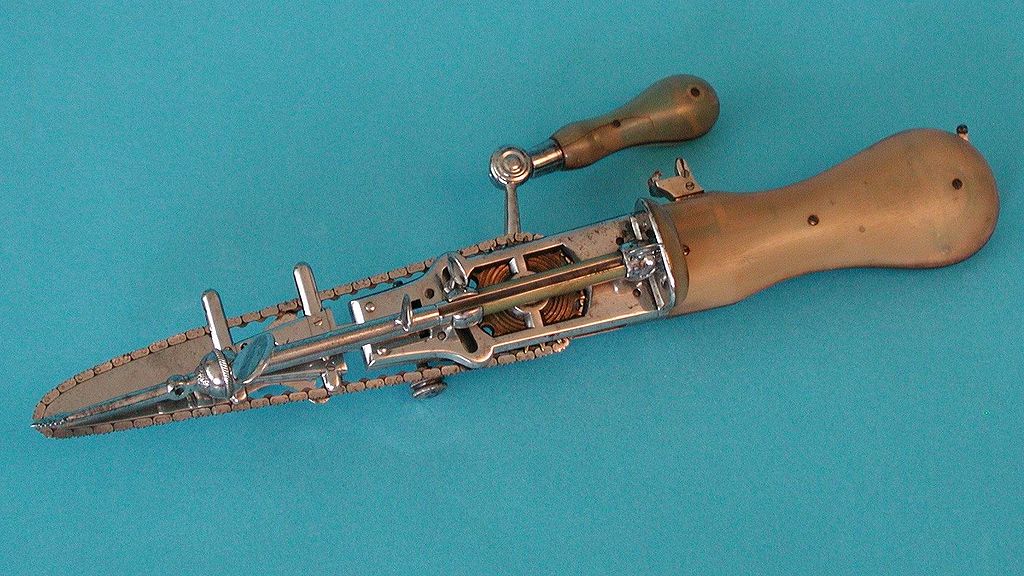

A probing tool recommended by my network (In retrospect, I should have been more specific).