A balancing act that we frequently face in manufactured spend and churning is knowing how hard to hit a deal. If you push it too hard, you may kill it in days. If you don’t hit it hard enough, you’re leaving money on the table – potentially a lot.

What’s the magic behind how hard you should hit a deal and when you should back off? In my mind it comes back to two fundamental questions:

- Who’s paying for your earnings?

- What metrics, compliance, and regulations are important to them?

If you can answer those two questions then you’ve got a guide for how much abuse a deal will tolerate. If, for example, you’re dealing with a small, local casino’s loyalty program that’s relentlessly focused on bringing in gamblers, you can bet that they’ll know pretty quickly if they start paying out a ton of rewards due to your shenanigans. So, I’d treat such a thing as a short, surgical strike and try and run the deal low and slow over months or years.

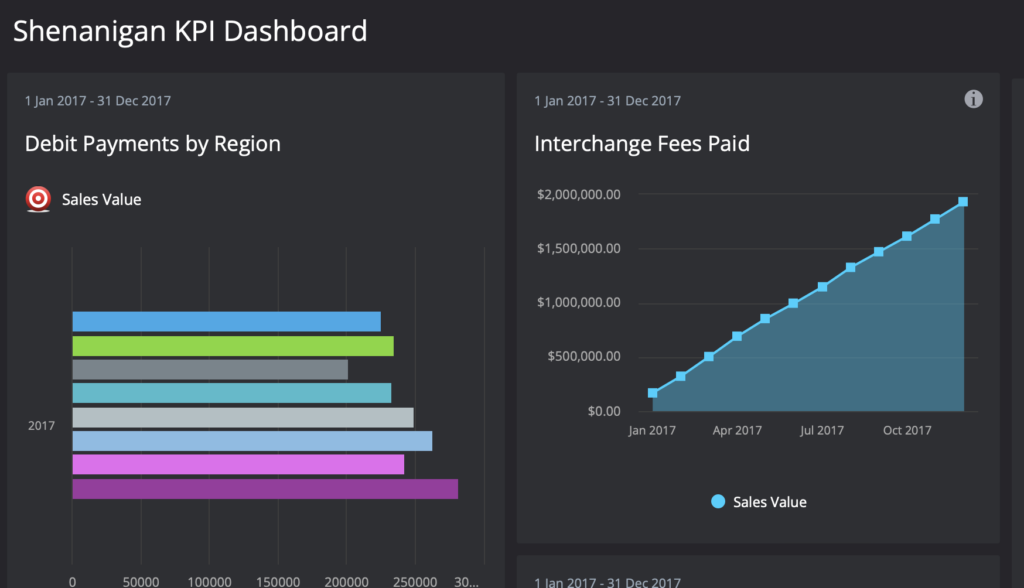

On the other hand, if you’re dealing with a dinosaur bank that has disconnected legacy systems and trillions of dollars in assets, your debit card funding would probably have to get well into seven or eight figures before it showed up as a blip on anyone’s KPI dashboard, and on top of that they’d have to be curious enough when they see it to dig in and figure out what’s going on. So, this one is a probably a pedal to the metal play, understanding that time and not volume will probably make the deal die.

So, an unsolicited suggestion: When you encounter a new deal, think about who is paying for it and what their regulations are as a guidepost.

Good luck!

Sample bank KPI shenanigan finder.