- The Chase Southwest Business cards have increased sign-up bonuses of 120,000 points, split into 80,000 points after $5,000 spend in three months and another 40,000 points after $15,000 spend in nine months. The offers expire September 16.

– Business Performance, $99 annual fee

– Business Premier, $199 annual fee

If you apply on September 15, call and move your statement date as far out as possible, and hit spend between January 1 and January 14, you’ll earn a companion pass for 2025 and 2026 with a single card. Ok, ok, technically you’ve got another six months past January 16 for the second part of the spend, but just check that box and get it over with. (Thanks to DDG) - The Chase IHG One Premier Credit Card has a new bonus of five free nights, each for up to 60,000 points a night, after $4,000 spend in three months. The $99 annual fee is not waived. The offer code indicates that it’s from an in-branch offer, so 5/24 will be more ymmv than normal.

This is a great offer for hotels in most cities, though 60,000 points doesn’t go very far in the most expensive places like New York, London, or Tokyo. It is, however plenty sufficient for no-one’s favorite Lubbock, TX and similar cities. - Last week, we talked about a no-lifetime language (NLL) link for the American Express Business Gold card with 150,000 Membership Rewards after $10,000 spend in three months. I know of two cases where the targeted link didn’t work last week but does this week, so it might be worth another shot.

- The generic American Express Business Platinum upgrade link has a targeted increased bonus of 120,000 Membership Rewards after $10,000 spend in three months. If you’re really quick, you can still get the first half of 2024 $200 Dell credit or at least a Dell cancelation email before the credit evaporates. (Thanks to FM)

- Wyndham has points on sale for 0.96 cents per point, with a maximum of 100,000 points. Why should you care? Vacasa, that’s why.

Have a nice weekend friends!

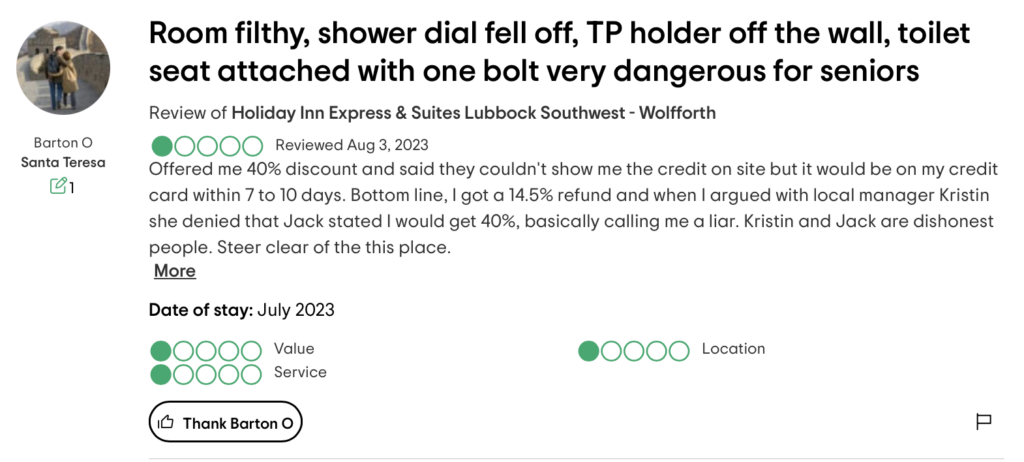

Obligatory IHG Holiday Inn Express & Suites Lubbock Southwest review.