Introduction

Let’s chat about the Dunning-Kruger Effect. But, before we get in too deep though, I’ll remind anyone who doesn’t remember immediately what exactly that effect is (a reminder for basically all of the other readers but you):

Dunning-Kruger Effect: When your confidence in a subject books an Emirates First flight to the moon, but your competence in that subject gets you a one way ticket to Lubbock, TX on Southwest.

– Remedial Psychology by non-Psychologist MEAB, Volume II

Practice

Manufactured spenders and churners are an astute, quick-thinking bunch, at least on average. They’re also happy to give advice and help others out of a tricky situation. Put those traits together though, and your average personality in the hobby has a tendency to speak with more bravado than is strictly warranted. That is, a lot of us are walking Dunning-Kruger Effect bots. Need a concrete example? You’re reading an article from a guy who’s formal psychological training consists of an expired library card. A few more examples:

- “<Bank> shutdowns are permanent”

- “That trick hasn’t worked since 2017”

- “I’ve done <churning thing> seven times this month, it’s completely safe!”

There are of course longer examples too, but you’ll have to find those on another blog that has at least four pop-up ads and two referral links for the Chase Sapphire Preferred™©®Ωµ® card.

Fin

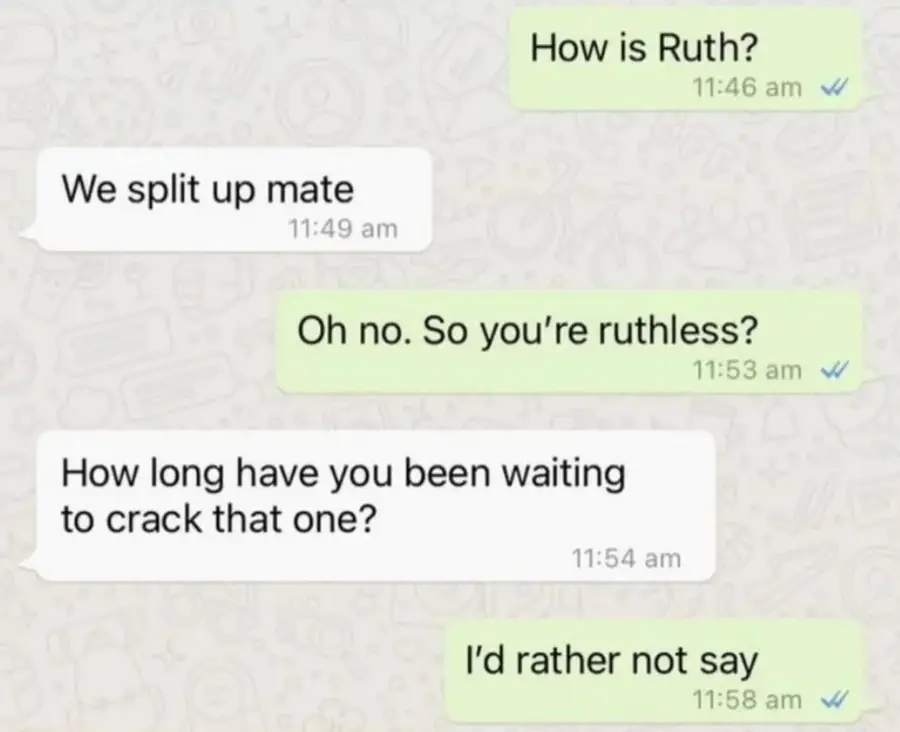

Let’s end with a conversation I overheard:

Everyone else: “Ok poindexter, so what?”

MEAB: “Listen to everyone in the hobby, we’re a smart bunch. But, apply appropriate skepticism.”

Everyone else: “Boring! Where are the free flights and stuff?”

MEAB: “…”

Have a nice weekend friends!

The guy who already did the thing seven times this month’s home plumbing