EDITOR’S NOTE: Matt is on vacation until at or around January 1, 2026. Until then we have guest posts, today’s post is brought to today’s post is brought to you by @MForch, a hardened churner turned advantage player turned future real estate baron. Special thanks for the post!

We all know the holy grail of this hobby: CPP (Cents Per Point). We obsess over whether that Hyatt redemption was 2.1 or 5.5 cents per point. We brag about the $15,000 First Class flight we bought for 80k miles.

But there is a much more important metric that almost no one in the churning community talks about: CPH (Cents Per Hour).

If you spend ten hours a week chasing a $200 bank bonus or driving to three different grocery stores to find the one cashier who still allows certain transactions, you aren’t winning. You’re just working a second job for minimum wage.

Laziness Backed by Science

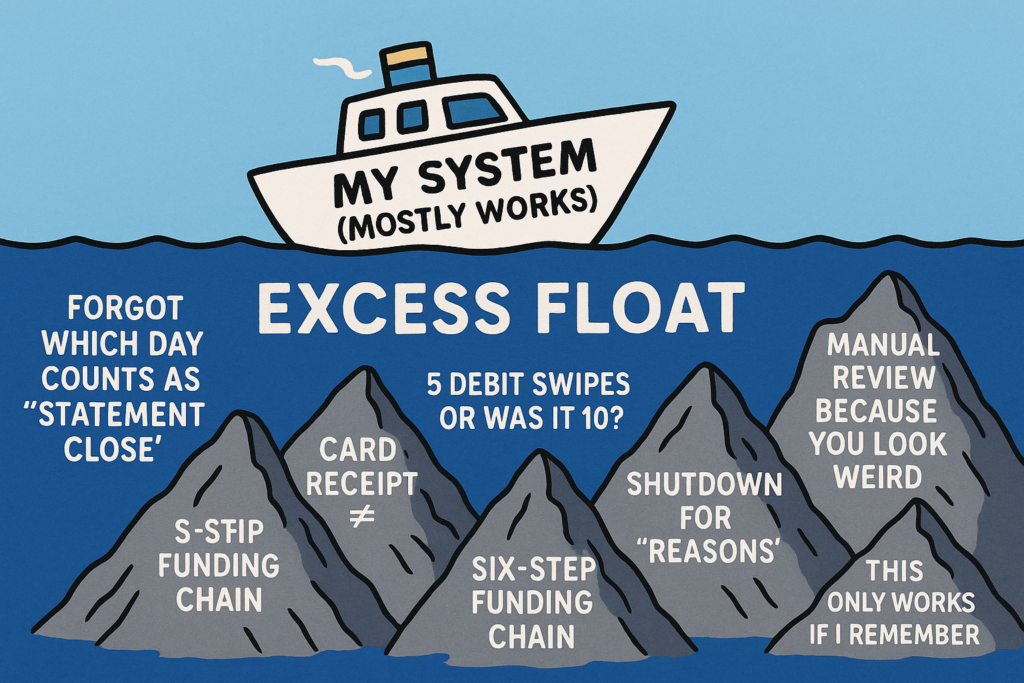

If you’ve ever read a self-help or business book, you can summarize 90% of them with one concept: The 80/20 Rule. 80% of your profits come from 20% of your activities. Usually, that’s high-level scaling a specific play that actually moves the needle. Yet, most people in this hobby spread themselves thin, spending time on every brilliant Amex Offer, hotel credits they could just do from a Vegas pool and every convoluted shopping portal stack. Reading all the blogs, message boards, slacks and discords(the emoji month later).You are falling into the rabbit hole because your return on time is abysmal.

Scaling vs. Scavenging

I recently had a conversation at a MEAB meetup with one of the many Davids in our corner of the internet. David is a hustler, saw some of myself in him—he was doing a little bit of everything. He had ten different plates spinning, most of them decent sized but not a real wage replacement.

I asked him point-blank: “Why aren’t you focusing on scaling what you’re actually good at?”

He was doing what most of us do: scavenging for crumbs because we’re afraid to miss out on any new play. I told him to pick the one play he saw as truly scalable and go all-in. He took the advice. Fast forward to today: he has 100x’d that single play and now has a Plum situation most of us are jealous of.

He didn’t find a new secret; he just stopped doing the small stuff so he had the bandwidth to scale the big stuff. That is pure gold.

My Shift: From Points to Property

Lately, I’ve been focused heavily on my Real Estate business. Why? Because for me, the return on time is simply better. A single successful property acquisition or a well-managed renovation yields a profit margin that makes a $500 referral bonus look like pocket change.

However I haven’t forgotten my churning tools to increase the ROI of my real estate plays.

The advantage player (AP) mindset doesn’t stay in the credit card world. I apply the same social engineering and optimization tactics to my real estate business:

- The Stack: Buy a gift card with a dash of this or an uber discount to fund renovation materials. Coupons for huge off or become a cash back monitor to squeeze some extra juice out of the deal.

- Social Engineering: Negotiating discounts with contractors(would you take credit card?) and stores using the same persistence we use with reconsideration lines for open or damaged items. Finding a friendly cashier for your shenanigans.

- Arbitrage: Finding the gap between what a property is worth and what I can get it for, just like finding a mispriced award seat.

- Taxes: Beating the fees while paying your taxes, Even prepaying just to get it returned days later at closing.

Know Your Worth

The Points and miles lifestyle isn’t about working harder; it’s about burning the least amount of your life energy for the most amount of profit.

If a play takes you four hours and nets you $40, your CPH is $10. You’re better off working at a Cracker Barrel and buying the points.

Stop spreading yourself thin. Look at your spreadsheet. Identify the one play that has the highest scalability and the lowest time commitment. Don’t stop paying attention just focus that attention. Your 80% isn’t my 80%- we all have different advantages in the world.

– @mforch

Pictured: @mforch