Another day, another grab-bag because that’s how this week rolls:

- The Citi AA personal (update: thanks to Gary for noting this is the personal version of the card, not the business version) card has an offer for 75,000 AAdvantage miles after spending $3,500 within four months, and the annual fee is waived for the first year. (Thanks to divinebaloon)

- An update from my attempt at getting more than 11 charge cards with American Express: I was denied because my account was already at the charge card limit. I have a theory about bypassing it though but won’t be able to try for a few more weeks, story developing.

- There was quite a bit of noise floating around yesterday about the American Express Delta Reserve card’s special 747-edition because 25% of its metal comes from a retired Delta 747-400. Normally I couldn’t care less about a special edition card, but this one tugs at my avgeek heart strings so here we are I guess.

If you want one and have an existing Delta Reserve card, you can request a replacement card directly from the website or mobile app with the reason “Change Card Design”, at which point you’ll be given a choice for the normal design or the 747 design. You can also apply for a new Delta Reserve to get it while supplies last, but the sign-up bonus has been 30% higher in the recent past so I wouldn’t go for it now.

- Some news on the manufactured spend front:

– Staples has started selling the “Everywhere” variety of gift cards, but reports suggest that the maximum face value is currently $100 (These are Metabank cards that are restricted to certain types of merchants but often work for manufactured spend in more places than regular gift cards)

– USPS has new terminals with new software, which means new opportunity

– The Paceline card has turned out to be very friendly to MS so far, perhaps it’s worth a second look (reader Fish and Vinh both report that limits aren’t always limits, which we all know happens a lot, right?)

Have a nice weekend!

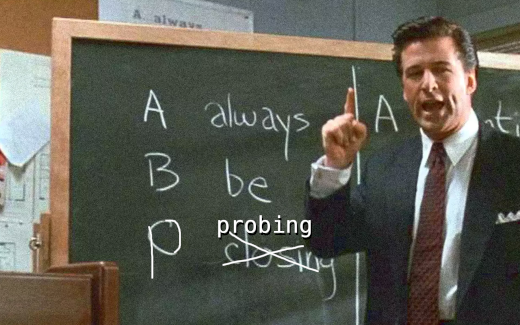

This week rolls in exactly the same way that this airplane doesn’t.