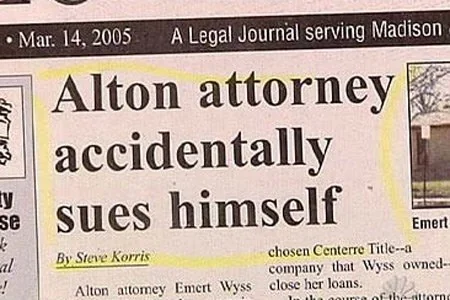

EDITOR’S NOTE: I flubbed the math in yesterday’s post. My only excuse is that I was using a cyrillic Soviet-era LED driven calculator and forgot to carry the Д when performing the Ж. I’ve updated the math and promise to learn Cyrillic before trying this again.

- The Chase Hyatt Business Card has a new heightened, tiered sign-up bonus matching the previous best offer:

– 60,000 World of Hyatt points after $5,000 spend in three months

– 15,000 World of Hyatt points after another $12,000 spend in six months

This one runs through September 26, and almost certainly won’t bypass 5/24. (Thanks to Parts_Unknown-) - Qatar Avios has devalued award redemption rates on AA and Alaska short and medium haul flights. The lowlights:

– Economy prices went up between 23% and 58%

– Business prices went up between 35% and 63%

This is of course the same kind of trash that you find in a junkyard after a tornado; but also we should expect that different carriers’ Avois point values are going to converge on one another eventually so it’s predictable trash. In the mean time, DansDeals has a great chart on the cheapest currencies for booking AA flights post Qatar’s devaluation. - Kroger has a 4x fuel points promotion on third party gift cards and fixed value Visa and Mastercard gift cards in-store tomorrow through Sunday. Amazon gift cards remain excluded and will only earn 2x points.

Happy Thursday!

The calculator used for yesterday’s post.