EDITOR’S NOTE: I’m on an annual blogging vacation for the last two weeks of the year. To make sure you still have content, some of the smartest members of the community have stepped up with guest posts in my absence. Special thanks to James, the host of the Churn and Burn podcast, who candidly shares his story on the dark side of credit card churning for writing this post. I’ll see you on January 1!

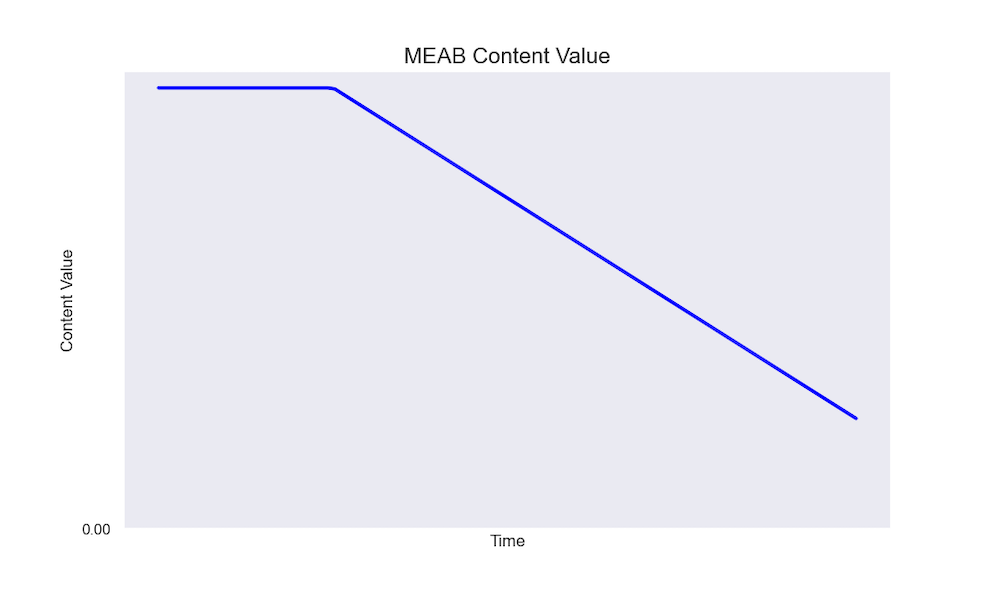

Some of you may remember that almost one year ago, I wrote a guest post with a simple plea: stop inflating the value of your points and start considering more carefully how you value said points and what they cost you to make. Today’s post is a followup to that one. But instead of looking at C.P.P. (cents per point), I’m going to ask you to look at a different, yet closely related metric: R.O.I. The true R.O.I. of spend can be absolutely incalculable. Yet still, it’s worth doing.

In the Summer of 2023, I decided to make a push for Delta Diamond status after I realized that a certain card which was “Reserved” for me could be used to “Reserve” a lot of lucrative offers which were asking me to spend in increments of $1000 for a grand total of 5,000 Skymiles each. Mind you, this was “back in the day” before Delta nuked their loyalty program. Actually, I really need to thank Delta for that, because it ended up being one of the best things that’s happened to me in my recent award travel memory, but more on that later…

Real ones know that Delta Diamond used to cost less than the average Venezuelan starter home…Although said “home” might have been a prerequisite.

Yes, as a Skymiles account holder with a pathetic 3,000 MQDs to my name, I knew the only way I’d make Delta Diamond was by knocking out the mammoth $250,000 MQD waiver requirement for credit card spend. For all of this spend, I accrued the following:

- 1,675,000 SkyMiles

- 4 Regional Upgrades

- 4 Global Upgrades (x2?!)

- Oh, and the Diamond status. That too.

I managed to parlay these upgrades into the following:

- 2 Roundtrip Transcon tickets on the A350 for only 48,000 SkyMiles

- 2 Roundtrip Delta One tickets to Rome for only 84,000 SkyMiles each.

- 2 More roundtrip Delta One Tickets to Rome thanks to a banking error in my favor (thank you Delta IT) for only 92,000 SkyMiles each.

For your own convenience, I’ve already done the math for us. The $250,000 in spend was done in a very lazy manner. You might say that I’d be called a floozy for doing so. In point of fact, I incurred a loss of $7,500 in order to complete this spend. So, what kind of ROI did my spend get me, if I value the above accrued items at fair market price?

- 1,675,000 SkyMiles = $19,262 per my own personal valuation

- 4 Regional Upgrades (RUCs) = $3,000ish in savings

- 8 Global Upgrades (GUCs) = $24,000 in savings

- A total of 6 measly first class Diamond Upgrades and obligatory premium economy = ????

You’re probably thinking that my valuations for the upgrades are insane. And of course, they are. A more appropriate valuation would be for me to decide how many SkyMiles I would have paid for those upgrades over economy and then applying that value. So let’s go ahead and assign a value of $1,400 and $8,400 to the RUCs and GUCs respectfully. I’ll conservatively value the complimentary upgrades at a very round $2,000 figure. Feel free to play mad libs with my math and fill in your own break point numbers. After all, it’s not my blog. I don’t make the rules! That gives us a grand whopping total of $31,062 in value after $7,500 in loss. It’s a very, very respectable ROI, and I hope you can hear the sound of my shoulder dislocating as I reach around to pat myself on the back. *Please clap*

But, as they say: “It ain’t over till it’s over.” That brings us to the Fall season of 2023, when Delta announced (probably because of me) that they were gutting the SkyMiles program like a suckling pig at the Calala Island bonfire.

Delta would later roll back several of these devaluations, but not before our friends at B6 (JetBlue) decided to lower an olive branch to all of us Delta Elite members who were jilted by our abusive partner and now found ourselves craving an illicit affair with our spouse’s trashier, broke neighbor. And what better place to have that affair than at the Motel (B6)? The offer: “Be the first of 30,000 to open up a JetBlue Card in the next 30 days, and we’ll give free Mosaic 4 status for all of you dirty Delta Diamonds out there.” At the time, this offer was largely ignored. I am only aware of a couple of close friends besides myself who took B6 up on it. What was promised seemed too good to be true, and maybe that’s why so many people didn’t bother. For my infidelity against Delta, I was given a heaping treasure haul consisting of:

- 6 “Move to Mint” vouchers

- 4 Blade Helicopter Transfers in the NYC area

- Unlimited non-mint upgrades on B6

These were all awarded to me fairly quickly after a successful match, and I used them to great effect:

- 3 one way Mint upgrades from JFK-EDI

- 2 Mint upgrades from PHX to JFK

- 4 Helicopter rides from JFK to Manhattan

- 5 B6 flights in the past year where myself and “P2” were treated to “front of plane” upgrades for free.

Perhaps the best part of all this is that I had already stashed around 100,000 B6 miles from a previous card signup offer, and the 2nd B6 credit card offer required of me for the status match accrued an extra 80,000 miles. All of this was utilized in order to book flights that I would later shower with Move to Mint certs. (As a brief aside, JetBlue knew they goofed with this campaign, because very quickly after this status match, the Move to Mint certificates were severely devalued. I very fortunately booked most of mine prior to that. Guess I’m just cool like that.) Calculating the value of all this is hard. Would I have paid out of pocket for all of those helicopter rides? Unlikely. So again, I’m going to apply the same math as before, and value these items at the price that I would have paid for them myself:

- 3 one way Mint upgrades from JFK-EDI ($3,000)

- 2 Mint upgrades from PHX to JFK ($900)

- 4 Helicopter rides from JFK to Manhattan ($440)

- 5 B6 flights in the past year where myself and “P2” were treated to “front of plane” upgrades for free. ($900)

It’s an additional $5,240 in value. Bringing our total valuation to $36,302. If we again consider our initial “investment” of $7,500” then we achieved a total ROI of 384%.

Enjoying my B6 Chopper ride over NY, which I apparently valued @ roughly $110? Who knew Bond was such a cheapskate?

At this point, if you’re still with me after watching me blow smoke up my own tailpipe for several paragraphs, I’ll finally quit burying the lede. There’s a few takeaways to be had, here:

- Many times, one person’s devaluation is another person’s play of the year.

- The true R.O.I. of a play is what you value it at, not the valuation of some person who doesn’t live in the same hub as you or frequent the same hotel chains.

- You should, frequently and ruthlessly, reassess the R.O.I. of various “investments” you are making and ask yourself if there are more lucrative R.O.I. plays to be made elsewhere.

- $250,000 of spend might sound like an astronomical amount for some of you reading. But I assure you that for others, it’s just another Tuesday. Something to think on.

- As MEAB says: “Always be probing.” You never know when a play will quickly open a new door into a different play.

- People will often scoff at you for spending on cards that most people wouldn’t take a second glance at. Trust your own compass. Every dog (of a card) has its day.

- The “noise” generated by a less lucrative play can often be used to arbitrage or “feed” another play. Sometimes you need to find yourself rolling in some cash before you can wade through the muck.

– James